Which crypto exchange should you use when you’re just getting started with cryptocurrencies?

Which Crypto Exchanges Are Best For Beginners?

You want an exchange that makes buying, selling, and storing crypto simple, secure, and reasonably priced. Below you’ll find a breakdown of key criteria, a curated list of beginner-friendly exchanges, practical steps to get started, and an in-depth explanation of the risks involved with unregulated exchanges.

What to Look for in a Beginner-Friendly Exchange

Choosing an exchange feels overwhelming at first, but you can simplify the decision by focusing on a few core areas. Each factor below affects how safe, convenient, and cost-effective your crypto experience will be.

Security

Security should be your top priority because exchanges hold large amounts of assets and are common targets for hackers. Look for exchanges with a strong track record, cold-storage policies, two-factor authentication (2FA), withdrawal whitelists, and insurance policies that cover certain losses.

Regulation and Compliance

Regulated exchanges follow local laws and usually perform Know Your Customer (KYC) checks. Regulation provides more consumer protection and clearer recourse if something goes wrong. If you value legal protections, prioritize exchanges that operate under the rules in your jurisdiction.

Fees and Pricing Structure

Fees affect your returns, especially if you trade often or in small amounts. Beginners often prefer straightforward fee schedules and transparent pricing. Watch for trading fees, deposit and withdrawal charges, spreads, and hidden costs tied to certain payment methods.

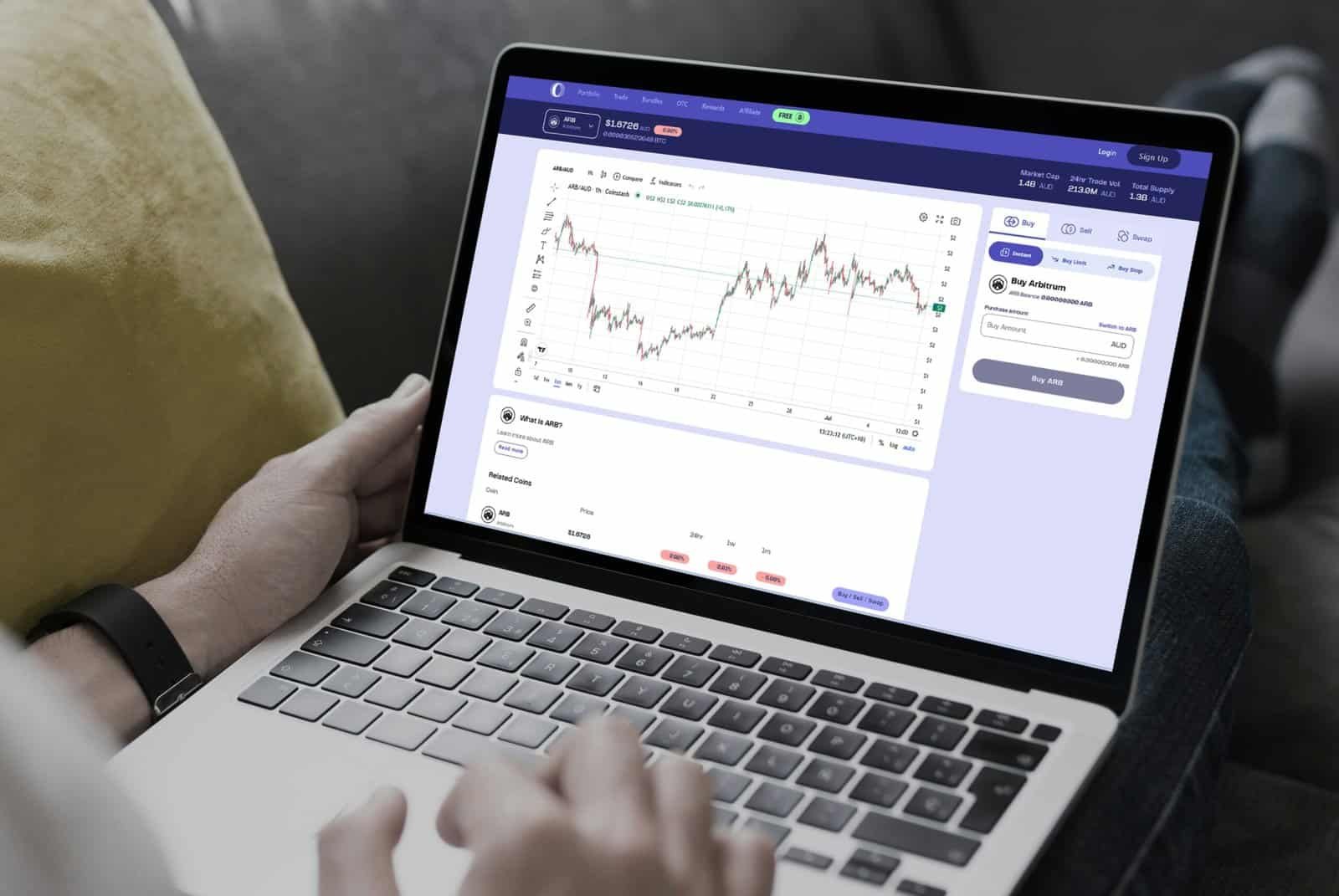

User Interface and Ease of Use

A clean, intuitive interface saves you time and reduces mistakes. Beginner-friendly platforms provide simple buy/sell workflows, clear order confirmations, and easy access to help and educational resources.

Supported Coins and Services

The number of supported cryptocurrencies matters if you plan to buy specific tokens. For a first exchange, having major coins (BTC, ETH, USDT/USDC) plus a few altcoins is usually sufficient. Also consider whether the platform offers staking, savings, or other crypto services you might want later.

Deposit and Withdrawal Methods

Convenient fiat on/off ramps are essential if you plan to convert between cash and crypto. Look for debit/credit card support, bank transfers, and ACH (in the U.S.), along with clear withdrawal limits and speeds.

Customer Support

When problems occur, reliable customer support is invaluable. Check available support channels (chat, email, phone), response times, and the presence of a help center or community resources.

Educational Resources

Good exchanges provide tutorials, articles, and videos to help you learn. These resources help you avoid common mistakes and grow your knowledge safely.

Mobile App

Most users manage crypto from mobile devices, so a well-designed app with parity to the web experience is important. Check app store ratings and update frequency.

Liquidity

Higher liquidity means you can buy or sell larger amounts without big price slippage. Established exchanges generally offer better liquidity for major coins.

Top Crypto Exchanges for Beginners

Below are exchanges widely regarded as suitable for new users. Each has unique strengths, so consider what matters most to you—ease of use, low fees, regulatory compliance, or supported coins.

| Exchange | Regulated (in many markets) | Best for | Notable pros | Notable cons |

|---|---|---|---|---|

| Coinbase | Yes (U.S., Europe) | Simplicity, fiat on-ramp | Simple UI, strong security, insured custodial assets | Higher fees on basic buys, limited altcoins vs big exchanges |

| Kraken | Yes (U.S., EU) | Security, advanced features for later use | Strong security, lower fees for traders, fiat support | UI slightly more complex than very basic apps |

| Gemini | Yes (U.S.) | Compliance and security | Regulated custodian, strong compliance, good educational content | Fees higher on instant buys, smaller altcoin selection |

| Binance (global) | Varies by country | Low fees, many altcoins | Very large selection of tokens, low fees, high liquidity | Regulatory issues in some regions; complex features |

| Binance.US | Yes (U.S., limited) | U.S. residents wanting Binance ecosystem | Lower fees, good coin selection within U.S. limits | Fewer tokens than global Binance, regulatory constraints |

| Crypto.com | Varies by market | All-in-one app and rewards | App + card + earning products, wide coin selection | Mixed customer support reviews, some product complexity |

| eToro | Regulated in many markets | Social trading, simple interface | Social features, copy trading, integrated fiat | Higher spreads, less crypto-native features |

| Bitstamp | Yes (EU, UK, others) | Simplicity and reliability | Long-running, reputable, good fiat support | Smaller altcoin catalog, basic trading features |

| Uphold | Regulated (varies) | Multi-asset trading | Supports crypto, stocks, metals; simple UI | Fees and spreads can be opaque for some instruments |

| KuCoin | Not regulated in many key markets | Wide altcoin access | Large token selection, low trading fees | Less regulatory oversight, higher risk for newbies |

Coinbase

Coinbase is often recommended to beginners because it focuses on simplicity. You can buy major cryptocurrencies with a few taps, and the platform emphasizes security and regulatory compliance. If you want a straightforward entry point and solid educational content, Coinbase is worth considering.

Kraken

Kraken balances beginner-friendly features with more advanced trading options as you grow. It has a strong security track record and works in many jurisdictions. You’ll find lower fees for traders and robust fiat support, making it a good long-term exchange.

Gemini

Gemini emphasizes regulatory compliance, custody solutions, and institutional-grade security. If you prioritize legal oversight and a clear regulatory framework, Gemini is a trustworthy option, especially in the U.S.

Binance (Global) and Binance.US

Global Binance offers the widest selection of tokens and some of the lowest fees, but regulatory status varies by country. Binance.US provides a more compliant option for U.S. users with a reduced token list. Choose them if you plan to trade many altcoins or want minimal trading fees.

Crypto.com

Crypto.com provides an app with many integrated services—an exchange, a card, staking, and savings-like products. It’s useful if you want a single platform with multiple crypto-related features, and the rewards program can be appealing.

eToro

eToro combines social trading with an accessible interface. You can copy other traders’ portfolios, which may help you learn trading strategies. Keep in mind spreads and fees differ from traditional crypto exchanges.

Bitstamp

Bitstamp is one of the longest-running exchanges and emphasizes reliability and simple fiat on/off ramps. It’s a solid choice if you value longevity and straightforward service.

Uphold

Uphold supports multiple asset classes and has a simple interface for converting between them. It suits users who want an all-in-one app for crypto and other digital assets.

KuCoin

KuCoin lists many altcoins and has low fees, but it’s less regulated in key markets. If you decide to use a platform like KuCoin, treat it as higher risk and avoid leaving large balances there.

How to Choose the Right Exchange for Your Needs

You can narrow choices by matching platform features to your priorities. Consider these scenarios and recommendations.

If You Live in the United States

You’ll likely prefer exchanges that operate under U.S. regulations to ensure clearer consumer protections. Coinbase, Kraken, Gemini, Binance.US, and Kraken are commonly used by U.S. residents. Check state-by-state availability and verify whether the platform supports your preferred deposit method.

If You Prioritize Low Fees

If minimizing fees is your top concern, look at exchanges with low maker/taker fees and low withdrawal charges—Binance (global) and KuCoin typically have among the lowest trading fees. Use limit orders to reduce trading fees and look into fee discounts tied to native tokens or VIP tiers.

If You Want Many Altcoins

For access to many projects, Binance (global), KuCoin, and Crypto.com list large token catalogs. Beginner caution: many altcoins are highly speculative; only allocate what you can tolerate losing.

If You Want Fiat On/Off Ramps

Choose exchanges with strong fiat support, such as Coinbase, Kraken, Gemini, Bitstamp, or Crypto.com. Check supported currencies, deposit methods (ACH, SEPA, SWIFT), and any fees tied to those methods.

If You Care About Privacy

Most reputable exchanges require KYC and personal information. If privacy is a priority, consider self-custody for your long-term holdings and be prepared that regulated fiat onramps will usually require identity verification.

How to Get Started Safely

Once you’ve selected an exchange, follow these practical steps to protect your funds and reduce mistakes.

1. Create an Account and Complete KYC

Open your account and verify identity according to the exchange’s requirements. KYC helps you access higher limits and regulatory protection. Use accurate information to avoid issues with future withdrawals.

2. Use Strong, Unique Passwords and 2FA

Choose a unique, strong password and enable two-factor authentication (preferably an app-based method like Google Authenticator or Authy). Avoid SMS-based 2FA where possible due to SIM swap risks.

3. Fund Your Account Carefully

Start with a small deposit to test the platform and withdrawal flows. Use secure payment methods and avoid instant card payments for very large purchases until you understand fees and limits.

4. Make a Small Test Withdrawal

Always withdraw a small amount to your personal wallet before moving large sums. This confirms you can access your funds and that wallet addresses are correct.

5. Consider Self-Custody for Long-Term Holdings

If you plan to hold significant amounts long-term, consider a hardware wallet for cold storage. Exchanges offer convenience, but you control keys and therefore the assets when you self-custody.

6. Beware of Phishing and Impersonators

Always verify website URLs, use bookmarks, and never click unverified links claiming to be support or login portals. Confirm official social channels and support email addresses.

7. Monitor Account Activity

Set up account alerts where available and check account activity regularly. Immediately lock your account and contact support if you notice unknown logins or withdrawals.

Risks of Using Unregulated Crypto Exchanges

Using an unregulated exchange can increase your exposure to a range of serious risks. If you choose such a platform, you should understand each risk and how to mitigate it.

Lack of Legal Recourse

If the exchange misappropriates funds, freezes withdrawals, or shuts down, you may have little or no legal path to recover assets. Without regulatory oversight, there’s often no supervised bankruptcy procedure or consumer protection.

- Mitigation: Keep only short-term trading balances on unregulated platforms. Self-custody long-term holdings in hardware wallets.

Higher Likelihood of Hacks and Poor Security

Unregulated exchanges may skimp on security practices, making hacks more likely. They might not have adequate cold storage, audits, or incident response plans.

- Mitigation: Research security practices, prefer platforms with proof of reserves or third-party audits, and avoid leaving large balances.

Exit Scams and Sudden Closures

Operators of unregulated exchanges can disappear with user funds or abruptly suspend withdrawals, leaving customers locked out.

- Mitigation: Use established platforms with transparent ownership and public corporate registration. Diversify where you hold funds.

Market Manipulation and Wash Trading

Unregulated venues may permit or facilitate market manipulation, fake trading volumes, and wash trading, which can distort prices and liquidity.

- Mitigation: Check order book depth, compare prices across multiple reputable exchanges, and use caution when trading low-cap tokens.

No Deposit Insurance

Many regulated exchanges offer some form of insurance for custodial assets or participate in schemes that protect customers. Unregulated platforms often lack these protections.

- Mitigation: Store only what you need for trading on custodial platforms and ensure long-term holdings are in private wallets.

Difficulty Verifying Assets and Custody

Unregulated exchanges may not publish proof of reserves or undergo audits, making it difficult to verify that assets backing customer balances exist.

- Mitigation: Prefer exchanges that provide cryptographic proof-of-reserves or independent audits.

AML/CFT and Legal Risk for Users

Using unregulated exchanges can expose you to anti-money-laundering (AML) risks and potential legal issues if the platform facilitates illicit activity. Authorities may freeze accounts or seize assets as part of enforcement actions.

- Mitigation: Stick to reputable, compliant exchanges and avoid transactions that could pose legal concerns.

Liquidity and Withdrawal Delays

Unregulated platforms may lack sufficient liquidity, causing large spreads and withdrawal delays during market stress. You might not be able to exit positions when you need to.

- Mitigation: Test withdrawal speeds and monitor order book depth before executing large trades.

Reputation and Support Issues

Customer support is often slow or unresponsive on unregulated platforms, and public support channels may be unreliable.

- Mitigation: Check third-party reviews, community feedback, and responsiveness to support inquiries before depositing significant funds.

Counterparty and Operational Risk

The exchange is a counterparty; operational failures, mismanagement, or internal theft can result in losses for customers.

- Mitigation: Limit exposure to any single counterparty and favor firms with proven operational controls and public accountability.

Below is a table summarizing these risks with suggested mitigations.

| Risk | What It Means | How You Can Mitigate |

|---|---|---|

| No legal recourse | Hard to recover funds if exchange fails | Use regulated exchanges; self-custody long-term holdings |

| Hacks/poor security | Higher chance of accounts being compromised | Check security history, enable 2FA, keep small balances |

| Exit scams | Operators disappear with funds | Use reputable platforms, low balances, diversify |

| Market manipulation | Fake prices/volumes affect trades | Compare prices across exchanges; avoid low-liquidity tokens |

| No insurance | No compensation for losses | Self-custody, spread risk across platforms |

| No audits/proof-of-reserves | Unclear if assets are backed | Prefer exchanges with audits and public proofs |

| AML/legal risks | Potential legal exposure | Use compliant exchanges, avoid risky transactions |

| Liquidity issues | Trouble executing trades or withdrawals | Test withdrawals and order book depth |

| Poor support | Slow or absent customer help | Check reviews and responsiveness before depositing |

| Operational risk | Internal failures/theft | Favor established companies with transparency |

Red Flags to Watch For

You should be able to recognize warning signs before depositing funds. These red flags often indicate higher risk.

- No corporate registration, public team details, or office address.

- Lack of KYC or overly lax processes combined with guaranteed returns.

- No proof-of-reserves or independent audits.

- Major negative reports in the crypto community about withdrawals or scams.

- Extremely high referral or affiliate rewards that prioritize sign-ups over safety.

- Hidden or opaque fee structures and unusual transaction policies.

- Unclear terms of service regarding custody and asset ownership.

If you see several of these signs, treat the platform as high risk and do not store significant funds there.

Use Cases When Unregulated Exchanges Might Be Used (and Cautions)

There are scenarios where people use less-regulated platforms—for very early access to new tokens, experimental trading, or geographic constraints. If you choose to use them, adopt strict safeguards.

- Use only small amounts you can afford to lose.

- Maintain separate accounts for experiments and your main holdings.

- Withdraw gains regularly and move them to self-custody.

- Avoid linking primary bank cards or accounts if the platform’s reputation is weak.

Always weigh the benefits of access to niche tokens against the higher risk profile.

Frequently Asked Questions

Are regulated exchanges always safer?

Regulation improves transparency and consumer protections, but it’s not a guarantee against hacks or internal malfeasance. Regulated exchanges still require security vigilance from you. They typically provide clearer legal paths for dispute resolution and often follow strict custody protocols.

Can you keep crypto on an exchange forever?

Technically you can, but it’s riskier to keep large amounts on an exchange long-term. Exchanges act as custodians, meaning they control the private keys. If you want full ownership and control, use a hardware wallet or another self-custody solution for long-term holdings.

What’s the difference between centralized and decentralized exchanges?

Centralized exchanges (CEXs) hold custody of funds and provide order-matching services. Decentralized exchanges (DEXs) allow peer-to-peer trades via smart contracts, often without custody or KYC. DEXs can be less regulated and pose smart contract risks, while CEXs carry counterparty risk.

How do fees work and how can you reduce them?

Fees include trading fees, spreads, deposit/withdrawal fees, and payment processing charges. Use limit orders, pick lower-fee trading pairs, verify fee tiers and discounts, and consider exchanging via bank transfer rather than credit card to reduce costs.

Is it safe to use a mobile app for trading?

Yes, provided you use the official app, keep your phone secure, use biometric locks and strong device passwords, and enable 2FA. Avoid trading over public Wi-Fi without a VPN and keep apps updated.

Final Recommendations

You’ll make better decisions by prioritizing security, regulatory standing, and ease of use. Start small, learn the platform, and gradually expand as your comfort increases. Keep these practical tips in mind:

- Use a regulated, reputable exchange for fiat onramps and major trades.

- Activate strong security measures (unique password, 2FA, withdrawal whitelist).

- Move long-term holdings to self-custody hardware wallets.

- Keep only operational funds on exchanges and withdraw profits regularly.

- Check multiple sources for exchange reputation, and test withdrawals with small amounts.

- If you use unregulated exchanges, limit exposure and apply stricter safeguards.

Choosing the right exchange is about balancing convenience, cost, and security to match your goals. If you treat exchanges as a tool rather than a place to store life-changing assets, you’ll reduce risk and build confidence as you learn the space.