Have you ever wondered what the top strategies for investing in cross-chain tokens might be? In a rapidly evolving crypto landscape, cross-chain tokens offer an intriguing investment opportunity that can sometimes seem a bit elusive. This article aims to provide you with a comprehensive guide to understanding and effectively investing in cross-chain tokens. So buckle up as we venture into the world of cross-chain token strategies.

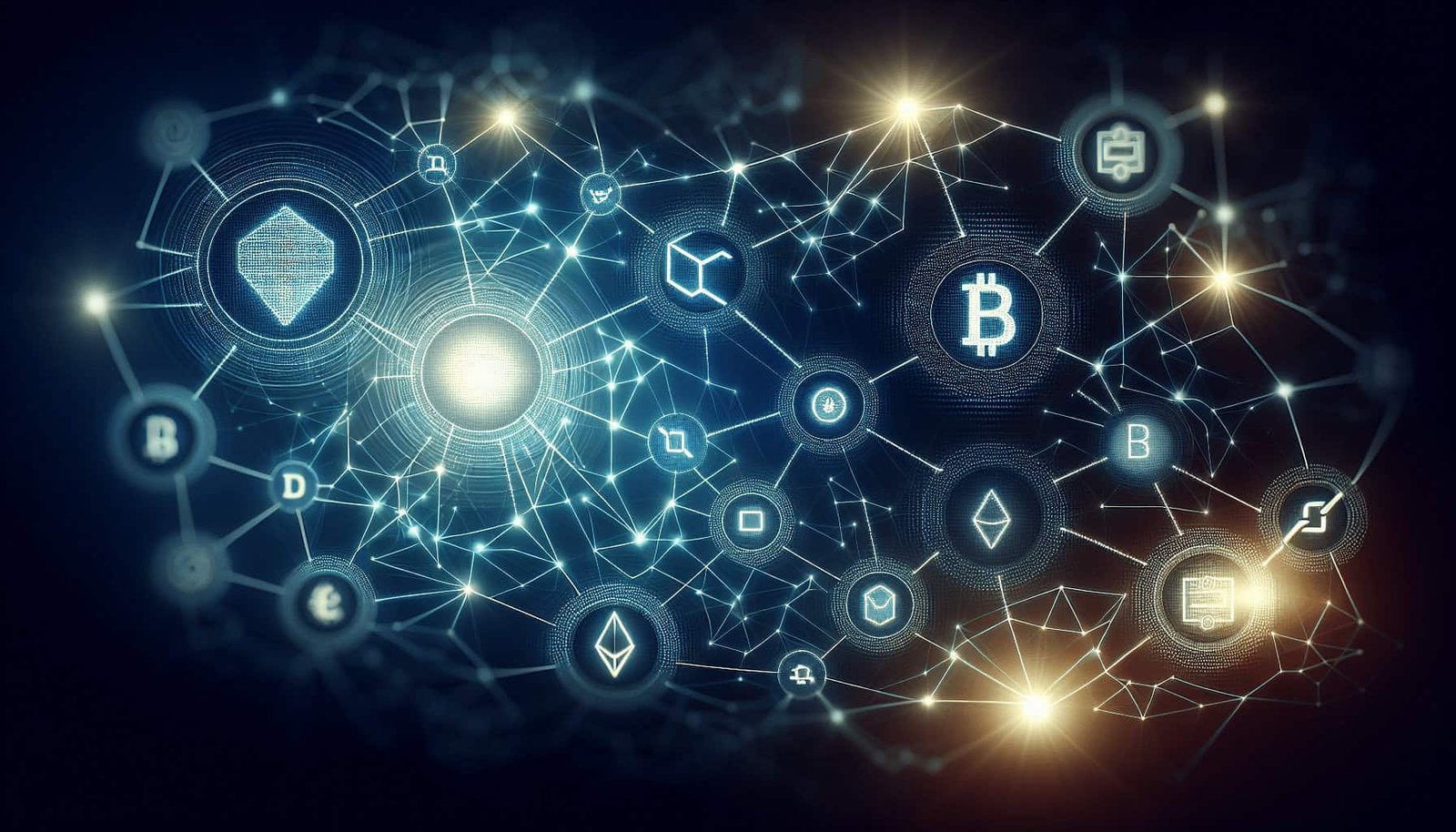

What Are Cross-chain Tokens?

Cross-chain tokens are digital assets that facilitate transactions across different blockchain networks. Unlike traditional tokens, which are confined to a single blockchain, cross-chain tokens can operate seamlessly across various blockchain ecosystems. This added flexibility increases their utility and opens new investment avenues.

Importance of Cross-chain Tokens

Why are cross-chain tokens important? They bridge the gap between disparate blockchain networks, enabling smoother transactions and broader access to different blockchain functionalities. This interoperability is key to developing a more integrated and user-friendly cryptocurrency ecosystem.

Evaluating Cross-chain Projects

Research the Team

A crucial initial step in evaluating any cross-chain project is researching the team behind it. Look into their backgrounds, prior projects, and overall credibility. Teams with a strong track record in blockchain technology are often more reliable and likely to succeed.

Examine the Whitepaper

The whitepaper offers a detailed explanation of the project’s goals, technologies, and methodologies. It’s essential to read the whitepaper critically to understand the project’s vision and feasibility.

Market Potential

Evaluate the market potential of the cross-chain token. Consider factors like target audience, market demand, and potential competitors. A comprehensive market analysis can provide invaluable insights into the token’s future value.

Diversification: The Golden Rule

Spread Your Investments

One of the fundamental rules in any investment strategy is diversification. Spread your investments across various cross-chain tokens to mitigate risks. This approach will protect you against the volatility that often accompanies new and emerging technologies.

Diversification Table

| Type of Cross-chain Token | Characteristics | Example Projects |

|---|---|---|

| Utility Tokens | Serve specific functions within a blockchain network | Chainlink, Polkadot |

| Governance Tokens | Allow holders to vote on network decisions | Uniswap, Compound |

| Security Tokens | Represent ownership in an underlying asset | tZERO, Polymath |

Timing the Market

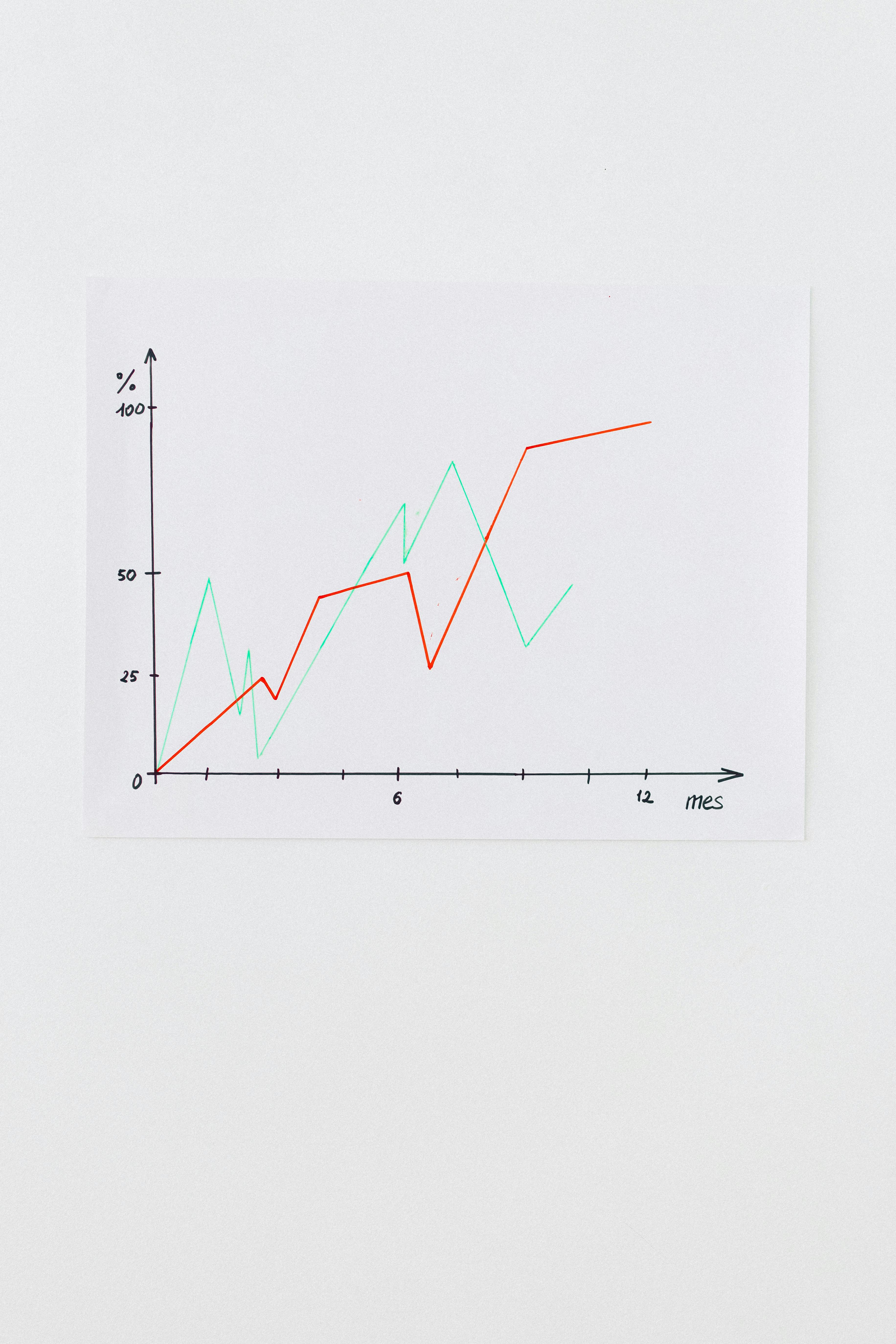

Market Trends

Keep an eye on prevailing market trends. Understanding when to buy or sell a particular cross-chain token can significantly influence your returns. Subscribe to crypto news outlets and follow industry experts on social media for timely updates.

Entry and Exit Strategies

Develop a well-defined entry and exit strategy. Determine the price points at which you plan to buy or sell. Sticking to your strategy can help you avoid emotional decisions driven by market volatility.

Risk Management

Set Stop-Loss Orders

Setting stop-loss orders can limit your losses in case the market moves against your position. By defining a minimum price at which you’re willing to sell, you can protect your investment from significant downturns.

Regular Portfolio Review

Frequent portfolio reviews are essential for effective risk management. Regularly assess the performance of your investments and make adjustments as necessary to align with your financial goals.

Technological Considerations

Interoperability

Assess the level of interoperability offered by the cross-chain token. Higher interoperability usually means that the token can interact seamlessly with more blockchain networks, thus increasing its utility and adoption.

Scalability

Scalability is another crucial factor to consider. The token should be able to handle an increasing number of transactions without compromising on speed or cost. Projects that offer higher scalability often have a competitive edge.

Legal and Regulatory Aspects

Jurisdictional Concerns

Regulations vary significantly across different jurisdictions. Ensure that you fully understand the legal implications of investing in a particular cross-chain token. Compliance with local laws is necessary to avoid potential legal pitfalls.

Regulatory News

Stay updated with the latest regulatory news affecting the cryptocurrency market. Changes in regulations can have substantial impacts on token prices and market sentiments.

Utility and Use Cases

Real-world Applications

Evaluate the real-world applications of the cross-chain token. Tokens with a broader range of use cases generally offer more stable investment opportunities.

Community Support

The strength of the community backing a particular token can be a good indicator of its potential success. Active and engaged communities tend to foster better developmental progress and broader adoption.

Long-term vs Short-term Strategies

Long-term Holding

Consider long-term holdings for cross-chain tokens with solid fundamentals and promising futures. Long-term investments can often yield higher returns and lower tax liabilities.

Short-term Trading

Short-term trading involves buying and selling tokens within a brief period. This strategy is more suited for experienced traders comfortable with higher risks and volatility.

Tools for Effective Analysis

Technical Analysis

Technical analysis involves studying historical price charts to predict future market movements. Tools like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands can provide valuable insights.

Fundamental Analysis

Fundamental analysis focuses on evaluating a token’s intrinsic value. Factors to consider include the project’s technology, team, market potential, and overall industry outlook.

Securing Your Investments

Hardware Wallets

Utilize hardware wallets to store your cross-chain tokens securely. Hardware wallets provide an added layer of security by keeping your assets offline and protected from potential cyber threats.

Multi-factor Authentication (MFA)

Employ Multi-factor Authentication (MFA) for an added security layer. MFA makes it significantly more challenging for unauthorized individuals to gain access to your accounts.

Educational Resources

Courses and Webinars

There are numerous courses and webinars available that cover the basics and advanced strategies of investing in cross-chain tokens. Leveraging these resources can provide you with a deeper understanding and aid in making informed decisions.

Forums and Community Groups

Participate in forums and community groups to gain insights and share experiences with other investors. Platforms like Reddit, Bitcointalk, and various Telegram groups are excellent for staying updated and connected.

Real-life Case Studies

Polkadot

Polkadot is one of the most well-known cross-chain projects. By enabling different blockchain networks to operate together seamlessly, Polkadot has garnered substantial attention and investment.

Cosmos

Cosmos aims to create an “Internet of Blockchains” by enabling different blockchain networks to communicate with each other. Its native token, ATOM, has shown promising growth, making it a popular investment choice.

Future Trends

Continuous Development

The field of cross-chain tokens is continually evolving. Innovations like zero-knowledge proofs and sharding are becoming more prevalent, promising to enhance the functionality and security of cross-chain tokens.

Wider Adoption

As more businesses and individuals adopt cross-chain solutions, the demand for these tokens is likely to increase. Keeping an eye on adoption trends can offer insights into future investment opportunities.

Conclusion

Investing in cross-chain tokens offers a unique blend of risk and reward. By conducting thorough research, diversifying your investments, managing risks, and staying updated with industry trends, you can navigate the complexities and potential pitfalls of this emerging market effectively. Exciting opportunities await for those who are well-prepared and vigilant, making it an attractive venture for seasoned and novice investors alike.