Do you ever wonder how advancements in blockchain technology and investment will shape the future of finance? Let’s explore some of the most intriguing recent developments in the field, starting with Parsec’s successful $4 million funding round.

Parsec’s $4 Million Funding Boost

Parsec, an innovative on-chain DeFi and NFT analytics platform, recently made headlines by securing $4 million in a funding round led by Galaxy Digital. This significant financial injection highlights Parsec’s potential to revolutionize how we analyze and interact with decentralized finance (DeFi) and non-fungible tokens (NFTs). It also demonstrates the growing interest and investment in blockchain technologies, emphasizing their critical role in modern finance.

Who is Parsec?

Parsec is a dynamic platform catering to the needs of DeFi and NFT enthusiasts, providing them with powerful analytics tools. With an ever-increasing number of decentralized applications (dApps) and digital collectibles, the necessity for robust data analysis tools becomes critical. Parsec steps into this gap, offering solutions that empower users to make informed decisions by providing deep insights into on-chain metrics.

Galaxy Digital’s Role

The investment round was led by Galaxy Digital, a prominent player in the cryptocurrency and blockchain investment space. Galaxy Digital’s involvement not only brings in necessary capital but also reinforces confidence in Parsec’s technological advancements and business model. Their endorsement is a vote of assurance for both current and potential users of Parsec’s platform, showcasing the importance major investors place in the development of cutting-edge blockchain tools.

Impact on the DeFi and NFT Markets

With this new funding, Parsec is poised to further develop its platform, potentially introducing more sophisticated analytics tools and enhancing user experience. The funding boost is not just a vote of confidence for Parsec but also a bellwether for the DeFi and NFT markets, signifying sustained interest and growth prospects within these sectors.

Legal Battle: BlockFi vs. Three Arrows Capital

In the dynamic world of finance, legal challenges are not uncommon, and the case between BlockFi and Three Arrows Capital (3AC) is a perfect example. This legal confrontation revolves around a hefty sum of $284 million in payments made before the latter filed for bankruptcy, underscoring the complexities of financial operations in the crypto realm.

The Conflict Explained

BlockFi, a well-known cryptocurrency lending platform, is engaged in a legal struggle with Three Arrows Capital over payments made prior to 3AC’s bankruptcy declaration. The dispute highlights the intricacies and potential risks associated with large transactions and the handling of assets when companies face financial turmoil.

Implications for Stakeholders

This legal battle has significant implications for stakeholders, raising questions about transparency, due diligence, and risk management when dealing with sizable financial transactions. As the case unfolds, it will undoubtedly provide crucial learning points for other firms in the crypto and financial sectors about managing contracts and mitigating risks.

Broader Repercussions for the Crypto Industry

Beyond the immediate parties involved, this dispute will likely influence regulatory scrutiny and risk management practices across the crypto industry. It illustrates the need for clear legal frameworks and robust financial controls to safeguard both companies and investors in similar high-stakes scenarios.

Security Checks on Soroban by the Stellar Development Foundation

Security in blockchain technology is paramount, and the Stellar Development Foundation takes this responsibility seriously with Soroban, its advanced smart contract platform. Conducting thorough security checks exemplifies how careful auditing and verification processes are critical for maintaining trust and reliability.

What is Soroban?

Soroban is an advanced smart contract platform developed by Stellar, aiming to enhance the functionality and security of its blockchain applications. As smart contracts become increasingly integral to blockchain operations, ensuring their security is of utmost importance to prevent vulnerabilities and maintain user trust.

Importance of Security Checks

Thorough security checks help identify and rectify potential issues before they can be exploited. For Soroban, these checks are crucial in building a robust platform that users can trust. By preemptively addressing security concerns, Stellar not only enhances its products’ reliability but also sets a standard for other blockchain platforms.

Stellar’s Commitment to Secure Development

This initiative reflects the Stellar Development Foundation’s commitment to maintaining secure and reliable blockchain solutions. Through rigorous checks, the foundation demonstrates its dedication to providing stakeholders with confidence in the technology they use, a vital component in the ever-evolving and fast-paced world of blockchain innovations.

Caroline Ellison’s Testimony Against Sam Bankman-Fried

The courtroom drama involving Caroline Ellison, former CEO of Alameda Research, and Sam Bankman-Fried, founder of the now-defunct FTX, has captured significant attention. This high-profile legal case provides a glimpse into the complex relationships and operations within the crypto financial ecosystem.

The Courtroom Drama

Ellison’s public testimony reveals intricate details about her professional relationship with Bankman-Fried and the internal dynamics of the firms they led. Her breakdown on the witness stand emphasizes the immense pressure and scrutiny involved in such high-stakes legal confrontations, particularly in the volatile world of cryptocurrency.

Insights from the Testimony

Her testimony offers rare insights into the operational strategies and decision-making processes at prominent crypto firms, potentially revealing vulnerabilities and questionable practices. The information from these testimonies could potentially shape future business strategies within the crypto industry, emphasizing better governance and transparency.

Broader Impact on the Crypto Landscape

This case is likely to influence regulatory bodies and governance in the crypto space, highlighting the need for clearer regulations and better oversight. The outcomes from this trial will probably reverberate across the industry, affecting how companies structure their operations and manage internal and external scrutiny.

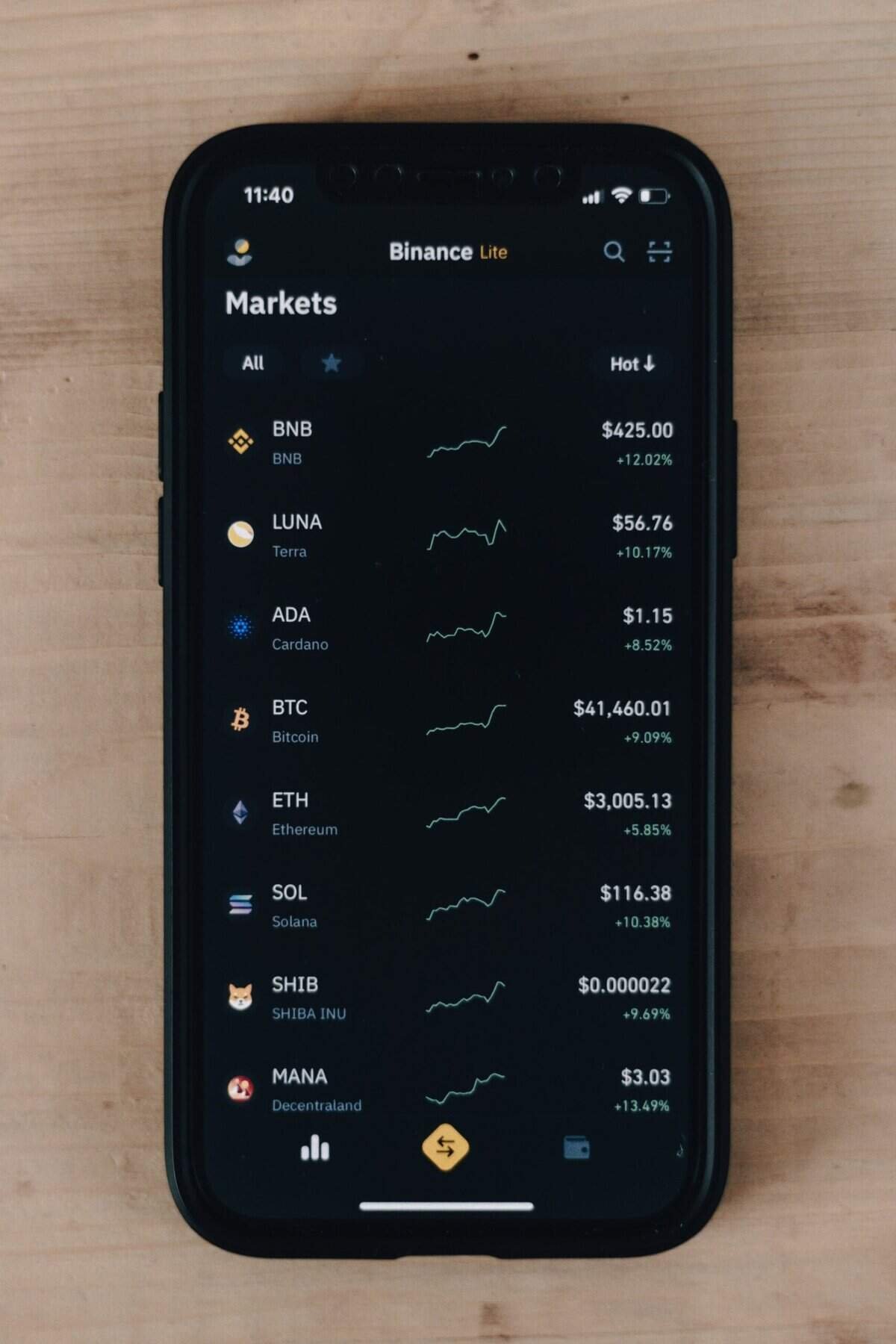

Bitcoin’s Enduring Appeal: Insights from K33 Research

In a constantly shifting cryptocurrency landscape, Bitcoin continues to hold its ground as the most attractive option, as found by K33 Research. This finding reinforces Bitcoin’s position not only as a pioneer but also as a prevailing force within the cryptocurrency arena.

Analysis by K33 Research

K33 Research extensively analyzed Bitcoin’s market behavior, particularly noting its higher premiums in futures trading. This data suggests that despite market volatility and the emergence of numerous cryptocurrencies, Bitcoin retains its allure for investors seeking reliable returns and opportunities.

Factors Contributing to Bitcoin’s Appeal

Various factors contribute to Bitcoin’s enduring popularity, from its foundational role in the birth of cryptocurrencies to its relatively stable market positioning and ever-improving infrastructure. The worldwide recognition and adoption of Bitcoin further bolster investor confidence, assuring them of its potential resilience amidst market fluctuations.

Implications for Crypto Investors

For investors, Bitcoin’s popularity underscores its strategic importance within an investment portfolio. Its enduring appeal can guide decision-making processes, encouraging a balanced approach to investments that leverage both the security of established assets and the innovation of emerging cryptocurrencies.

Conclusion

The evolving world of blockchain and cryptocurrency continues to be a fascinating arena of innovation, investment, and legal development. From Parsec’s impressive $4 million funding round to the intense legal battles of BlockFi and Three Arrows Capital, these developments shape the future financial landscape. Security validations on platforms like Soroban, courtroom revelations from industry leaders, and research insights on Bitcoin’s enduring allure further highlight the dynamic nature of this industry. As you ponder your own position within this transformative realm, these stories offer a wealth of knowledge and inspiration, reminding us of the endless possibilities that lie within the world of blockchain and cryptocurrency.