Have you ever wondered how a marketplace can be built around speed, pro-trader tooling, and multi-chain ambition while keeping your costs and latency to a minimum?

Tensor – A Fast, Pro-trader-focused Marketplace On Solana With Multi-chain Growth

This article explains what Tensor is, why it matters for you as a trader or creator, and how its architecture and strategy aim to make NFT trading faster and more professional. You’ll get clear descriptions of the marketplace’s features, technical foundations on Solana, multi-chain expansion challenges and approaches, comparisons with competitors, practical strategies you can use, and the risks to watch. Each section gives a friendly, second-person explanation so you can apply the information right away.

What Tensor is and who it’s built for

Tensor is a marketplace built on Solana that targets professional NFT traders by prioritizing execution speed, low latency, and trading-oriented features. It focuses less on consumer-grade discovery and more on tools that let you trade efficiently: orderbook-style matching, bulk transactions, programmatic APIs, private listings, and interfaces fine-tuned for fast decision-making.

If you trade actively, run bots, or engage in arbitrage, Tensor is designed with your workflows in mind. It brings market-grade primitives—orderbooks, maker/taker dynamics, and bundling—to the NFT space to reduce friction and improve execution quality.

Why Tensor matters in the broader NFT ecosystem

You’ll notice a few trends when you follow NFT marketplaces: trading sophistication is increasing, pro traders want lower fees and faster execution, and cross-chain liquidity is becoming essential. Tensor matters because it addresses these needs by:

- Prioritizing execution speed so you can react faster to market events.

- Offering pro-focused features to support market makers, arbitrageurs, and professional buyers/sellers.

- Planning multi-chain growth to reduce liquidity fragmentation across chains.

These focus areas help push NFT markets from simple buy/sell UIs toward more traditional market microstructure—something that can benefit professional participants and improve market efficiency for everyone.

How Tensor’s design leverages Solana’s strengths

Tensor’s base layer is Solana, which provides key technical advantages you’ll appreciate as a trader:

- Low latency and high throughput: Solana processes many transactions per second and has sub-second finality in many cases, which helps you place and settle orders quickly.

- Parallel transaction execution: Solana’s runtime (Sealevel) allows parallel processing of transactions when appropriate, reducing bottlenecks for high-volume activity.

- Low transaction costs: Fees on Solana are typically a fraction of those on many other L1s, lowering your friction when executing many operations or bundling trades.

Tensor builds on these characteristics by designing an order execution and matching system that minimizes on-chain roundtrips and is optimized for rapid fills and composite transactions.

Orderbook-style trading vs. simple listing models

Traditional NFT marketplaces often rely on collections of listings that must be directly accepted by a buyer or mint contract. Tensor favors an orderbook or exchange-like model where you can place bids and asks in a structured way. For you as a trader, that means:

- More predictable execution: Orders can match on a queue rather than relying only on a maker to accept an offer.

- Bundles and atomic transactions: You can bundle multiple assets or actions into a single transaction for atomicity—either everything succeeds or nothing does.

- Better API support: An orderbook model maps naturally to programmatic strategies and market-making bots.

Core features that benefit you as a pro trader

Below are the main features you’ll encounter on Tensor and how they help your workflow.

Low-latency UX and trade execution

Tensor emphasizes speed at both the client and protocol level. You’ll find interfaces and APIs designed to minimize roundtrip time between identifying an opportunity and executing the trade. For fast traders, every millisecond matters—especially when arbitrage or sniping drops are on the table.

Advanced order types and private listings

You can use advanced order types such as limit orders, bundled orders, and private listings. Private listings let you negotiate off the public marketplace and execute a swap when both sides are ready, reducing public exposure—and the likelihood of predatory bots or snipers interfering with your transaction.

Aggregation and routed fills

Tensor aggregates liquidity and can route orders to the best available fill paths—on Solana and, as it expands, across bridged or layer-2 liquidity sources. This aggregation helps improve fill probability and minimizes slippage on larger trades.

API-first and bot-friendly tooling

If you want to run trading algorithms or integrate into your stack, Tensor’s APIs and SDKs are built to support high-volume, programmatic access. You’ll find endpoints for order placement, monitoring, and bulk operations—useful for market making or arbitrage bots.

Bundles and atomic transactions

Tensor supports bundling multiple NFTs into a single order or transaction. That atomicity is crucial: you won’t end up partially filled in a way that exposes you to unintended risk. Bundles are valuable for portfolio rebalancing and transferring collections across wallets efficiently.

MEV and front-running mitigation strategies

Front-running and MEV (Maximal Extractable Value) are real problems in NFT trading. Tensor uses private listings, timed auctions, and other mechanisms intended to reduce the opportunity for bots to extract value from your orders. While no system is immune to MEV, these features reduce its surface area for many scenarios.

How Tensor approaches multi-chain growth

Tensor’s multi-chain ambition aims to bring its pro-trader experience beyond Solana and onto other chains where NFT liquidity is meaningful. Multi-chain growth presents several challenges and opportunities you should understand.

Challenges you’ll face (and what Tensor has to solve)

- Liquidity fragmentation: As liquidity spreads across chains, execution quality depends on intelligent routing and consolidation.

- Bridge risk: Cross-chain transfers rely on bridges or wrapping mechanisms, which introduce security and latency trade-offs.

- Asset wrapping and provenance: When moving assets cross-chain, provenance and ownership metadata must remain trustworthy and verifiable.

- Consistent UX: You’ll expect the same tooling and latency expectations across chains, which is technically difficult given differing L1/L2 characteristics.

Practical multi-chain approaches

Tensor—or any marketplace aiming for cross-chain—can use a mix of approaches to minimize these problems:

- Cross-chain order routing: The marketplace can match orders on one chain while settling via bridging or coordinated cross-chain execution, striving for atomicity.

- Liquidity stitching via wrapped assets: Minted “wrapped” representations can stand in for assets on other chains, provided bridges and custodial guarantees are robust.

- Layer-2 expansions: Deploying on L2s or rollups that prioritize low fees and high throughput (while maintaining security guarantees) can provide intermediate steps.

- Relayer networks and cross-chain settlement: Off-chain relayers and provable settlement mechanisms can coordinate trade execution across chains to reduce latency and failure risk.

For you, the effective result should be that Tensor aims to offer similar pro-level trade primitives on multiple chains while minimizing the risk and complexity you face when moving liquidity.

Security and trust considerations you should monitor

When you use a pro-focused marketplace, the technical sophistication is great—but so is the complexity. Here are key security and trust aspects you should check.

Smart contract audits and on-chain safety

Look for public audits of the marketplace contracts and regular security reviews. Audits don’t guarantee safety, but they show the team’s commitment to best practices. You’ll want to know whether they use upgradeable contracts and how upgrades are governed, since that affects long-term risk.

Bridge and custodian risk for multi-chain moves

If Tensor offers cross-chain transfers, you’ll face bridge risk. Any wrapped or bridged assets depend on the secure operation of relayers or custodians. You should understand the bridge’s security model and the economic incentives that protect it.

Royalties, creator protection, and enforcement

Maker royalties are a hot topic. Tensor’s stance on royalties, and the technical enforcement (or lack thereof), affects how creators and collectors interact. If you’re a creator, check how royalties are enforced and whether marketplace features respect your royalty settings.

MEV and observational surface area

MEV remains a problem. While Tensor implements measures to reduce front-running, you should be cautious when placing public orders, using timed auctions, or executing large bundles—especially during high volatility.

Revenue model and business mechanics

You’ll want to know how Tensor monetizes, since fee structures directly affect your returns.

Typical fee structures

- Protocol fees: Tensor may charge a percentage fee on successful trades; for pro traders, fee tiers or maker/taker models can lower cost for liquidity providers.

- Creator royalties: Marketplaces either enforce royalties via smart contracts or leave enforcement to secondary layers; check what Tensor supports.

- Premium features: Advanced APIs, private marketplaces, or enhanced analytics may be monetized separately.

Understanding the fee model helps you design trading strategies that remain profitable after costs.

Fee incentives and maker/taker dynamics

Marketplaces that encourage maker liquidity often offer rebates or lower fees to makers. If you provide liquidity or use limit orders frequently, such incentives reduce your trading cost and improve market depth—something you should factor into market-making strategies.

How to use Tensor as a trader — a practical guide

This section gives you clear steps and strategic guidance to make the most of Tensor’s pro-trader features.

Getting started

- Wallet setup: Use a Solana-compatible wallet (like Phantom or Solflare) with secure seed storage. For multi-chain activity, you’ll need wallets that support the other chains Tensor targets.

- Account hygiene: Use a separate wallet for high-frequency trading or bot activity to isolate risk.

- Connect safely: Verify you’re using the official Tensor site or API endpoints and avoid signing unexpected transactions.

Trading workflows you’ll find useful

- Market making: Place limit orders on both sides of a spread, use maker incentives (if available), and manage inventory with bundled sells.

- Arbitrage: Use fast execution and low fees to exploit price differences across marketplaces or chains; bundling helps ensure atomicity.

- Sniping and drops: Private listings and fast fill mechanics help you capture primary mints, but consider anti-sniping measures by other participants.

- Large-lot sales: Use bundles and private listings to sell many NFTs in one transaction without partial fills.

Using APIs and automation

If you run bots, integrate with Tensor’s API for low-latency order placement and monitoring. Keep these best practices in mind:

- Rate limits: Respect rate limits and design exponential backoff to avoid being blocked.

- Transaction batching: Where possible, bundle transactions to reduce on-chain fees and ensure atomic outcomes.

- Monitoring: Use webhooks or socket connections for real-time fills and mempool watch to react quickly to market events.

Competitor landscape — how Tensor compares

Below is a high-level table comparing Tensor with other major marketplaces to help you position what Tensor offers for you:

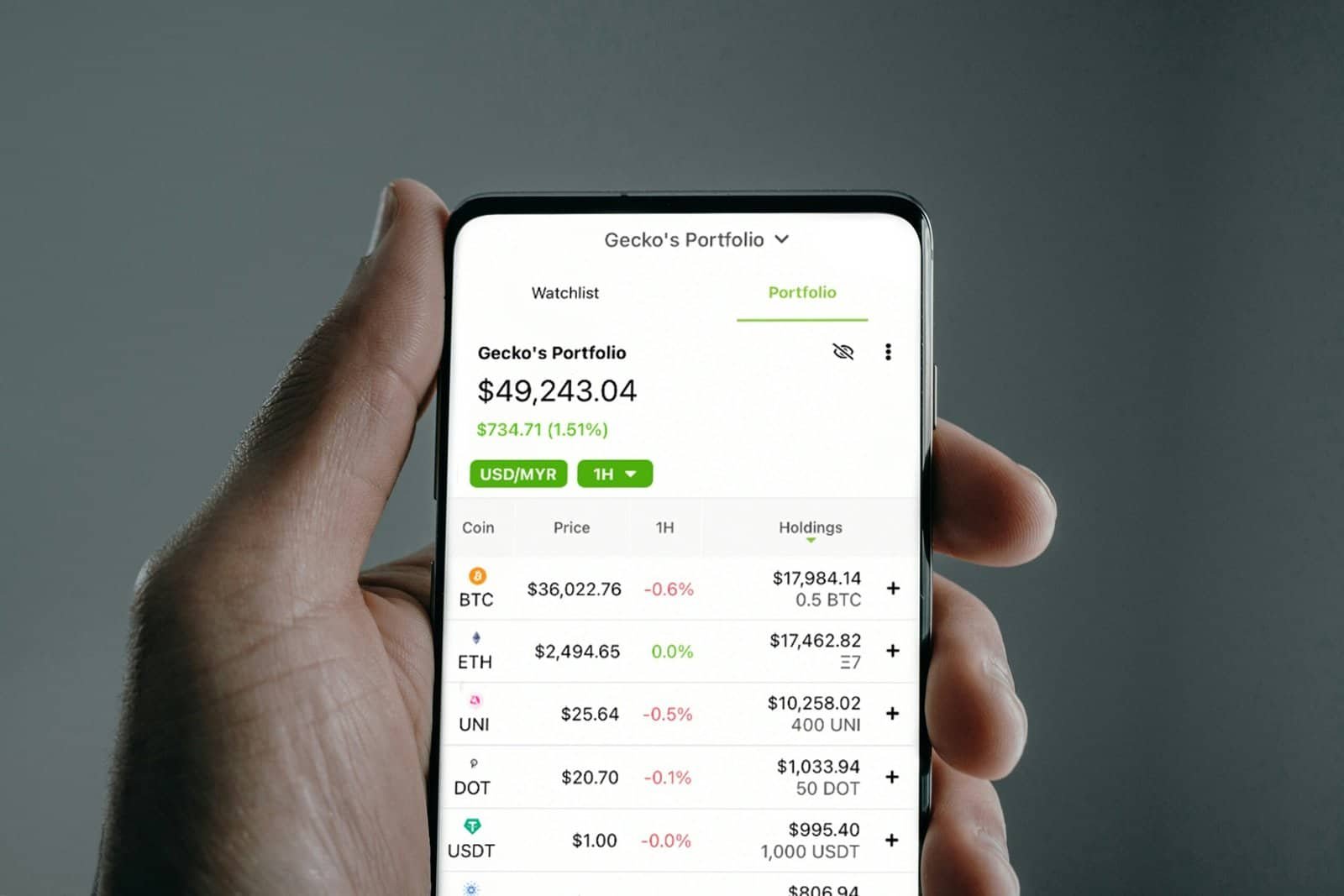

| Feature / Marketplace | Tensor (Solana-first) | Magic Eden (Solana) | Blur (Ethereum-first) | OpenSea (Multi-chain) |

|---|---|---|---|---|

| Pro-trader focus | High | Medium | High | Low-Medium |

| Orderbook support | Yes (pro-focused) | Primarily listings | Yes (pro tools) | Primarily listings |

| Speed & fees | Low fees, low latency | Low fees on Solana | Competitive, but Ethereum fees higher | Higher fees depending on chain |

| Bundles & atomic trades | Yes | Yes | Yes | Limited |

| API & bot friendliness | Strong | Good | Strong | Good |

| Multi-chain presence | Growth-focused | Primarily Solana | Ethereum-focused | Broad but UX varies |

This table is a simplified comparison—features and quality evolve quickly, so treat it as a snapshot. For you, the main takeaway is that Tensor positions itself as a Solana-first, pro-trader marketplace focused on speed and advanced tooling.

Tokenization and governance — what you should know

Tensor’s governance and token plans may evolve. If a native token or governance model becomes part of the platform, you should look for these properties:

- Governance participation model: How much say token holders have over protocol upgrades or fee allocation.

- Token utility: Fee rebates, staking, or priority access for pro features.

- Distribution and vesting: Fair distribution and responsible vesting schedules reduce the risk of large sell pressure.

Until Tensor’s governance model is clearly defined, prioritize protocol security and product-level value rather than speculative expectations.

Potential pitfalls and risks to watch

As an active participant, you need to manage a set of platform-specific and general crypto risks:

- Smart contract risk: Bugs or exploits can affect your assets or trades.

- Bridge and custody risk for cross-chain activity: Bridges are a common source of loss.

- Liquidity risk: Thin markets increase slippage during large trades.

- Regulatory risk: Policy changes can influence marketplace operations and tax obligations.

- Counterparty risk: Private listings rely on counterparties behaving as agreed.

Mitigation strategies include: keeping funds in hardware wallets when idle, using reputable bridges, limiting exposure during volatile markets, and thoroughly testing any trading bot or automated flow in a sandbox.

Roadmap and what you can expect as Tensor scales

If Tensor expands successfully, you can expect several concrete improvements that matter to you:

- Broader multi-chain coverage: More markets and sources for arbitrage and liquidity.

- Enhanced API and latency improvements: Tighter integrations for faster trading.

- Governance and token mechanics: Potential incentives for liquidity providers and long-term stakeholders.

- Improved analytics and risk controls: Tools that help you manage inventory, limits, and exposure.

Your optimal approach is to stay updated with official channels and test new features in low-risk ways before scaling up allocations.

Practical trading strategies that work well on a pro marketplace

Here are several strategies tailored to a fast, pro-trader-focused marketplace like Tensor. Each one assumes you’ve validated fees, slippage, and security.

Market making with maker rebates

If Tensor offers maker incentives, you can place limit bids and asks to capture spread while collecting rebates. Key points:

- Use small tick sizes and dynamic rebalancing to avoid inventory blowouts.

- Automate inventory skewing when you accumulate too much of one side.

- Monitor volatility to widen spreads during stress conditions.

Cross-market arbitrage

Use price differences between Tensor and other marketplaces, or between wrapped and native versions of assets across chains:

- Ensure atomic execution where possible (bundles or coordinated transactions).

- Account for bridge fees and settlement delays when arbitraging across chains.

- Watch out for wash trading or manipulated prices.

Bundle flips and portfolio rebalancing

Buy mispriced bundles on one platform and redistribute on another, or rebalance your portfolio into higher-demand sets.

- Use atomic bundles to avoid partial execution.

- Model expected slippage and marketplace fees before committing.

Private deal facilitation

Negotiate off-market private sales and execute via private listings to reduce exposure to snipers.

- Verify counterparty identity where possible (on-chain reputation, trusted counterparties).

- Use escrow or conditional execution features to safeguard the transaction.

How Tensor benefits creators and collectors

Tensor’s pro-trader design also brings advantages to creators and collectors:

- Faster settlements let collectors move assets quickly and participate in ephemeral events.

- Better price discovery from pro traders and market makers can improve valuation efficiency.

- Bundling and targeted drops give creators new ways to structure sales and collectors a way to buy curated sets.

Creators should check how royalties are handled and whether Tensor provides analytics to track secondary sales.

Final considerations — how to start using Tensor responsibly

To get started with Tensor in a way that protects you and maximizes value:

- Learn the platform: Read documentation, API docs, and security policies.

- Start small: Test strategies with small positions before scaling.

- Isolate risk: Use separate wallets for trading and long-term holding.

- Automate carefully: Backtest bots thoroughly and monitor them closely.

- Stay informed: Follow the project’s official communications to catch fee, governance, or cross-chain updates.

Conclusion — what Tensor aims to deliver and what that means for you

Tensor aims to be a marketplace that treats NFT trading with the same mechanics and seriousness you’d expect in other financial markets—fast matching, advanced order types, bundling, low fees, and strong API support—first on Solana, with ambitions to grow across chains. If you’re a pro trader, market maker, or a creator who wants efficient secondary market mechanics, Tensor’s approach is tailored to those needs.

By understanding the technical foundations, multi-chain challenges, security trade-offs, and practical strategies described here, you’ll be better prepared to use a pro-trader marketplace effectively and responsibly. Remember that while faster execution and advanced tooling can improve outcomes, they also require stronger operational controls and careful risk management.