Do you ever wonder where the world of cryptocurrency is headed, given its volatile nature and evolving dynamics? The cryptocurrency market is a fascinating landscape filled with opportunities and risks. To navigate it successfully, one needs insights and guidance from reliable sources. Bloomberg, renowned for its financial news and analysis, often provides valuable perspectives on this ever-changing market. Let’s explore some insights from Bloomberg on the current crypto market trends and perspectives, shaping decisions for investors like you.

The Current State of the Crypto Market

The crypto market is buzzing with activity, and as an investor, you are likely curious about its present condition. In recent years, cryptocurrencies have gained immense popularity, moving from niche technological novelties to major players in the financial markets. With Bitcoin and Ethereum leading the charge, the market has expanded to include thousands of digital assets. Bloomberg frequently highlights how these developments impact the financial landscape, shedding light on trends and emerging patterns.

Major Players and Their Influence

Bitcoin and Ethereum often dominate conversations in the crypto world. This dominance is due to their market capitalization, adoption rates, and technological innovation. Bitcoin is often referred to as digital gold due to its limited supply and store-of-value properties. Ethereum, with its robust smart contract capabilities, powers a significant portion of the decentralized finance (DeFi) ecosystem. Bloomberg’s analyses emphasize the critical role these cryptocurrencies play and how fluctuations in their value impact the broader market.

Additionally, Bloomberg has pointed out the rising influence of other players, such as Binance Coin, Solana, and Cardano, each offering unique functionalities and use-cases, which in turn affect investor sentiment and behavior.

Regulatory Environment and Its Implications

Regulation remains one of the hot topics in the crypto world. Different jurisdictions are grappling with how best to approach digital currencies. Bloomberg provides insights into regulatory trends across the globe, highlighting actions by key markets like the United States, Europe, and Asia.

In the United States, regulatory bodies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are clarifying their stances on cryptocurrencies. Bloomberg’s reports offer detailed views on the implications of such regulatory frameworks, examining how they could either stifle or stimulate innovation and growth.

Bloomberg also explores the effects of international regulations, using case studies like China’s stringent policies and Estonia’s favorable crypto environment, helping you evaluate the global regulatory landscape.

Trends Shaping the Crypto Market

What are the underlying trends influencing the current crypto market? Identifying and understanding these can be crucial in guiding your investment strategies. Bloomberg’s in-depth analysis helps investors like you navigate through predominant trends.

DeFi: Redefining Financial Services

Decentralized Finance, or DeFi, has revolutionized how financial services are offered. Rather than relying on traditional banking systems, DeFi uses blockchain technology to offer services such as loans, insurance, and exchanges, directly on the blockchain. Bloomberg’s reports on DeFi provide insights into how these offerings are challenging conventional financial systems.

As DeFi continues to mature, Bloomberg outlines both the opportunities and the challenges ahead, such as scalability issues, security concerns, and regulatory compliance. Understanding these can help you capitalize on potential opportunities and mitigate risks.

The Rise of NFTs

Non-Fungible Tokens (NFTs) have taken the digital world by storm. These unique digital assets, representing ownership of content like art, music, and even tweets, have captured both public imagination and market attention. Bloomberg extensively covers the phenomenal rise of NFTs and how they’re diversifying investment portfolios.

Bloomberg highlights how industries such as entertainment, sports, and art are leveraging NFTs to create new revenue streams. For investors, understanding the NFT marketplace can open doors to new types of investments previously considered unconventional.

Technological Advancements and Innovations

Innovation is at the heart of the crypto market. Blockchain technology continues to evolve, ushering in new capabilities like Layer 2 solutions that aim to solve issues of scalability. Bloomberg’s coverage of technological innovations highlights how advancements such as smart contracts and interoperability between different blockchains are paving the way for a more integrated digital economy.

Having insight into these technological progressions allows investors to foresee potential market shifts and the emergence of new disruptive players, helping position your investments aligned with these advancements.

Perspectives on Crypto Market Challenges

Every investment opportunity also comes with its challenges. The inherent volatility, evolving regulations, and technological hurdles pose significant challenges. Here’s what Bloomberg suggests about navigating these complexities.

Volatility: Balancing Risk and Reward

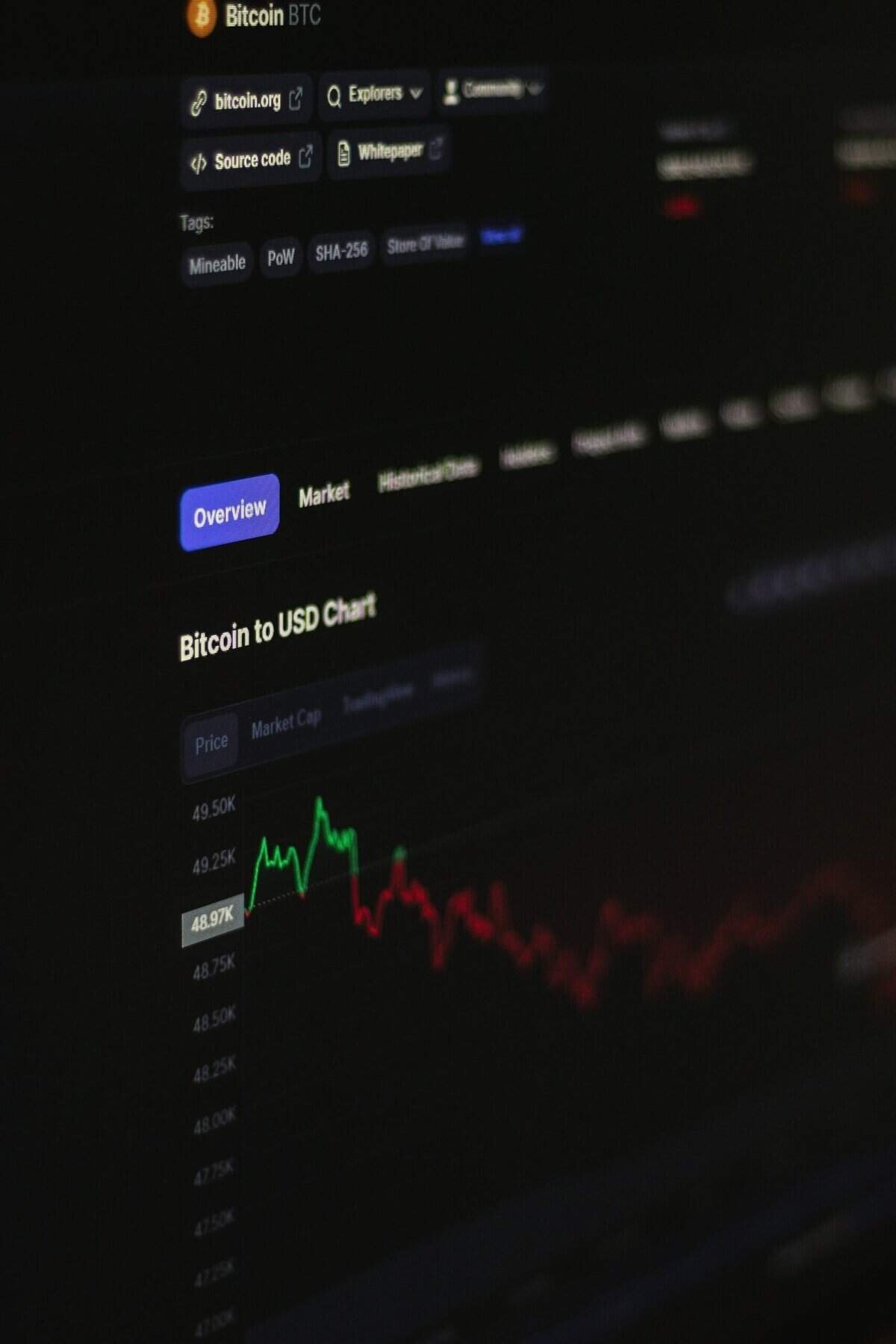

Cryptocurrencies are notorious for their volatility. Price fluctuations can be extreme and unpredictable, which can be daunting if you’re not well-prepared. Bloomberg often analyzes market volatility, offering strategies to manage risk, such as diversification of portfolios and implementing stop-loss orders to limit exposure to sudden downturns.

Awareness of market cycles and sentiment also plays a critical role, as highlighted by Bloomberg. Enhancing your understanding of these factors can help you anticipate market movements and make informed decisions.

Security Concerns

Security remains a critical concern in the crypto market. The decentralized and largely unregulated nature of cryptocurrencies can expose them to fraud and hacking. Bloomberg’s coverage provides valuable insights into protecting assets, discussing topics such as securing digital wallets, understanding smart contract vulnerabilities, and the importance of choosing reputable platforms.

With constant developments in blockchain security, staying informed through trusted sources like Bloomberg ensures you remain vigilant and protect your investments effectively.

Navigating Regulatory Changes

Regulatory landscapes are constantly shifting, which can impact crypto operations. Bloomberg articles often discuss how such changes can influence market conditions. Staying updated with compliance requirements and understanding regulatory impacts can safeguard your investment decisions from unexpected legal challenges.

Monitoring such developments provides you the agility to adjust strategies accordingly, reducing the risk of negative surprises and positioning you to take advantage of supportive regulatory environments.

Future Prospects According to Bloomberg

Given the constant evolution of the crypto space, what future prospects can investors expect? Bloomberg provides forward-looking insights, helping you anticipate upcoming changes in the market dynamics.

Adoption by Institutional Investors

Institutional adoption of cryptocurrencies is on the rise. With more significant financial entities recognizing the potential of digital assets, Bloomberg analyses emphasize the role institutions are likely to play in the market. Increased interest and involvement from pension funds, hedge funds, and corporations can stabilize the market and provide a sense of legitimacy, encouraging further investments.

Bloomberg’s discussions reflect how institutional interest might influence regulatory frameworks and market infrastructure, offering clues on future market stabilization trends.

Evolving Role of Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies are another area of interest. CBDCs represent a new frontier in digital finance, aiming to bridge the gap between fiat currencies and digital ecosystems. Bloomberg provides insights into the development of CBDCs and their potential impact on traditional and digital financial landscapes.

By understanding the implications of CBDCs, you can better assess how they might influence crypto adoption and integration with existing financial systems.

Conclusion

The crypto market is a complex yet exciting space. Bloomberg’s insights provide a robust framework to understand and navigate the ongoing developments within the industry. From understanding the major players and their influence to recognizing regulatory trends and technological advancements, the information is crucial in making informed investment decisions. As you explore the crypto market, leveraging Bloomberg’s analyses can guide you through opportunities and challenges, positioning you strategically for the future of digital finance.