Have you ever wondered how you can invest in NFTs without bearing high risk? This question might have crossed your mind, especially when the world of non-fungible tokens seems to be both thrilling and daunting. Understanding how to navigate this fascinating but risky field can be challenging, but with the right insights and strategies, you can make informed decisions and manage risks effectively.

Understanding NFTs: A Brief Overview

Before diving into strategies for low-risk investment, it’s essential to understand what NFTs are and why they’re significant. NFTs, or non-fungible tokens, represent unique assets that exist on a blockchain. These assets can range from digital art to music, in-game items, and even virtual real estate. Each NFT is distinct, meaning that it can’t be replaced with another, which gives it value.

The Value Proposition of NFTs

NFTs have become popular because they allow creators to sell digital items as unique pieces, while also providing proof of ownership. For buyers and investors, NFTs represent a way to own a piece of the digital landscape, potentially for prestige, support of artists, or investment growth.

The Risks of NFT Investments

Despite the potential rewards, investing in NFTs comes with its set of risks. These can include the volatility of the market, the potential for loss if an NFT’s value decreases, and broader concerns like security and ownership rights. It’s crucial to be aware of these risks when considering entering the NFT space.

Strategies for Risk-Managed NFT Investing

To invest in NFTs without taking on excessive risk, you can apply several strategies. From diversification to careful evaluation, these tips can help you make smarter investment choices.

Start with Education

The first step in reducing risk in NFT investment is educating yourself. Understand the market dynamics, how blockchain technology works, and the legal implications of owning an NFT. Familiarize yourself with different NFT platforms and what they offer.

Diversify Your Portfolio

Just like with traditional investments, diversification is a key strategy for managing risk. Don’t put all your money into one type of NFT or one artist. Spread out your investments across different types of NFTs to mitigate the impact of any single asset’s downturn.

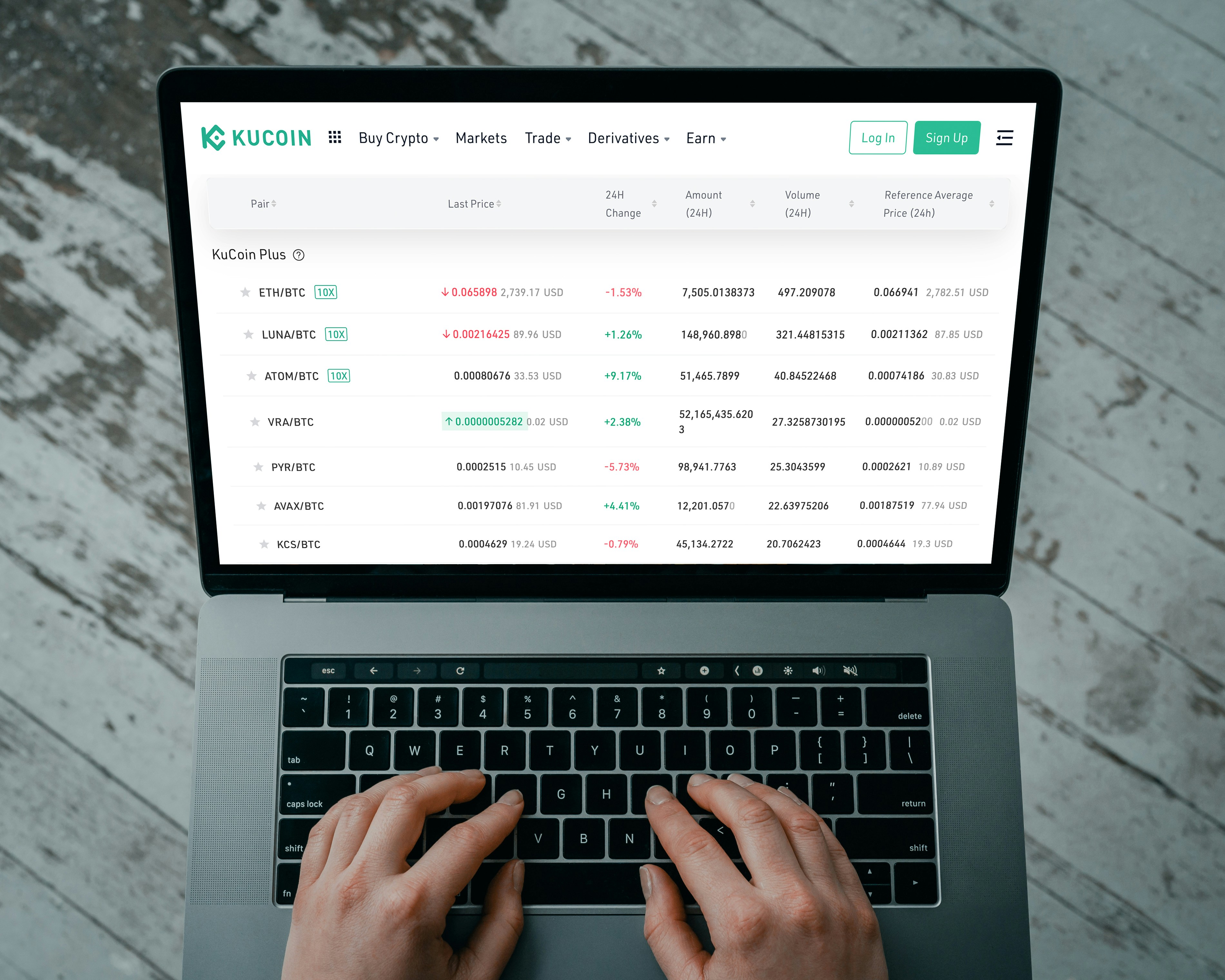

Evaluate the Platform

Not all NFT marketplaces are created equal. Before investing, research the platform’s reputation, fees, security features, and user reviews. Reliable platforms reduce the risk of fraud or technological issues.

Assess Creator Credibility

Understanding the credibility of the NFT creator can provide insights into the potential value retention of an NFT. Research the creator’s history, past projects, and community reputation. Well-known and respected creators tend to produce higher-quality NFTs, which might be less susceptible to drastic value drops.

Analyze Market Trends

Keeping an eye on market trends is essential. This includes understanding which types of NFTs are gaining popularity and which ones are losing steam. Market analysis can guide you on when to buy or sell, and what types of NFTs to consider adding to your portfolio.

Set a Budget and Stick to It

Another risk management tip is to set a strict investment budget. Decide how much money you are willing to invest in NFTs and do not exceed that amount. This will help you avoid emotional spending driven by market hype.

Tools and Resources for NFT Investment

In addition to strategic approaches, utilizing various tools and resources can help in making informed NFT investment decisions.

NFT Analytics Platforms

Platforms offering analytics and insights into NFT sales, market trends, and asset valuation can be incredibly useful. Tools such as NonFungible, DappRadar, and CryptoSlam track NFT transactions and provide valuable data.

Community Engagement

Joining NFT-focused communities can provide insights and warnings you might not receive elsewhere. Forums like Reddit’s NFT community or Discord channels often have experienced investors who share their knowledge and tips.

Legal Resources

Since NFTs involve ownership and transaction rights, familiarize yourself with the legal aspects. Resources like law firms specializing in blockchain and intellectual property law, as well as government publications on cryptocurrency regulations, can be useful.

Reducing Environmental Impact

Investing ethically also involves considering the environmental effects. NFTs, especially those on energy-intensive blockchains, have a significant carbon footprint.

Eco-Friendly Blockchains

Consider investing in NFTs that are minted on eco-friendly blockchains like Flow or Tezos. These blockchains use less energy, reducing the environmental impact of your investment.

Supporting Sustainable Projects

Invest in projects that contribute to sustainability. Some NFT projects actively contribute a portion of their proceeds to environmental conservation or operate using offsets to reduce emissions.

Long-term Outlook on NFTs

While the excitement around NFTs might make it tempting to focus on short-term gains, a long-term perspective can help in managing risks.

Focus on Fundamental Value

Instead of getting caught up in current price trends, consider the fundamental value of the NFT. What long-term utility does it provide? Is it important to a larger digital economy or creative movement?

Be Prepared for Volatility

The NFT market can be highly volatile, with values fluctuating wildly. Prepare mentally for periods of downturn and resist the urge to sell in a panic.

Establish an Exit Strategy

Decide beforehand when it’s the right time to exit an investment. Whether it’s reaching a certain value, achieving a particular market condition, or hitting your financial goal, having an exit strategy can prevent hasty decisions.

Conclusion

Investing in NFTs without high risk is achievable with a thoughtful and informed approach. By understanding the landscape, using strategic investment practices, and leveraging available tools, you can participate in the NFT market while managing potential downsides. Remember, the key is balance—between curiosity and caution, excitement and prudence. Investing in NFTs can be a rewarding journey if you navigate the risks wisely and patiently.