How familiar are you with the current events shaking up the cryptocurrency world? With so much happening, it’s hard to keep track of the latest developments. Today, let’s take an informative journey through the most buzzing crypto news and emerging trends. From the intriguing trial of Sam Bankman-Fried to the ripple effects of regulatory decisions, the landscape is as dynamic as ever.

Sam Bankman-Fried and the FTX Trial

One of the most captivating events taking the headlines is the trial of Sam Bankman-Fried, the former CEO of FTX. Bankman-Fried’s legal battles have become a focal point in the crypto world, not only due to the significant financial implications but also because of the questions they raise about regulatory frameworks and the future of crypto exchanges.

Understanding the Case

Since October 3, Bankman-Fried’s trial has been underway, with his defense yet to craft a compelling narrative. Accusations of fraud and financial mismanagement hover over FTX, creating waves within the sector. The trial has reignited discussions around the safety and transparency of crypto exchanges.

The Defense Strategy

As the trial progresses into its second week, many are curious about the possible defenses Bankman-Fried’s legal team might present. However, the defense seems to face an uphill battle, with testimonies from several witnesses, including Caroline Ellison, former partner and CEO of Alameda Research, poised to provide crucial insights.

Ripple’s Legal Wins Against the SEC

While FTX faces legal scrutiny, Ripple continues to experience significant victories in its lengthy battle with the U.S. Securities and Exchange Commission (SEC). A judge recently denied an appeal from the SEC, marking another favorable outcome for Ripple.

Ripple’s Legal Ground

Ripple has been in the legal spotlight since December 2020 when the SEC accused it of using XRP to raise funds in violation of securities laws. The recent win suggests a possible shift in how XRP is perceived under securities regulations, but interpretations of this legal victory remain mixed within the crypto law community.

Broader Implications

Ripple’s ongoing legal saga could redefine cryptocurrency regulations and influence how other digital assets are categorized. This case is crucial for understanding potential future regulatory guidelines that may emerge globally.

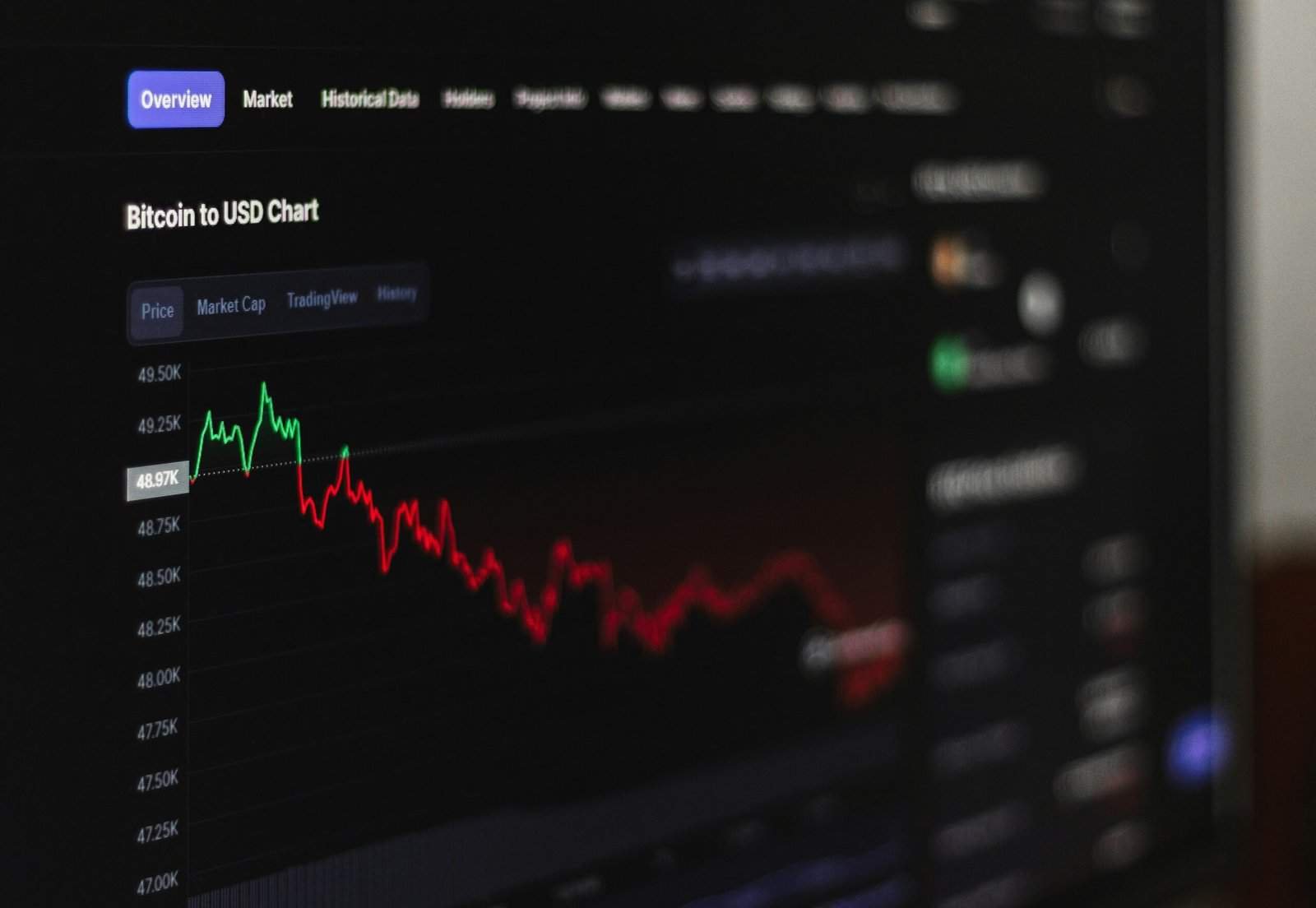

Market Movements and Economic Influences

Cryptocurrency markets are notoriously volatile, and several external factors currently impacting Bitcoin and Ethereum prices are worth noting. The intersection of global events, economic indicators, and investor sentiment plays a crucial role in shaping the market landscape.

Bitcoin’s Price Fluctuations

Recent geopolitical tensions, including conflicts in the Middle East, have injected volatility into the markets, affecting assets like gold, oil, and consequently affecting Bitcoin. Bitcoin prices have been hovering around the $28K mark, with traders suggesting that significant buying pressure is needed to break through current resistance levels.

Ethereum’s Current Status

Meanwhile, Ethereum faces its own challenges. A lack of enthusiasm for the recent Ethereum Futures Exchange-Traded Funds (ETFs) has resulted in heavy selling, contributing to Ethereum’s downward price trend. The response of major investors will likely dictate Ethereum’s short-term price movements.

Technology and Innovation in Blockchain

Beyond price swings, the crypto ecosystem is constantly evolving with innovative technological advancements. These developments aim to enhance functionality and expand the potential uses of blockchain technology.

BitVM and Smart Contracts

One such innovation is BitVM, which aims to bring Ethereum-like smart contract capabilities to the Bitcoin network. This development could redefine how decentralized applications are created on Bitcoin, providing a broader range of functionalities and potential uses.

The Role of Web3 and DeFi

The growth of Web3 communities and decentralized finance (DeFi) projects remains a significant trend. For instance, initiatives like ‘Crypto Aid Israel’ demonstrate how blockchain technology can be used for humanitarian aid, showcasing the versatile potential of decentralized platforms.

Regulatory Developments and Global Impact

As crypto technology advances, regulations continue to evolve to keep pace. Recent discussions and proposed changes highlight the delicate balance between fostering innovation and ensuring consumer protection.

The UK and European Regulations

In the UK, cryptocurrency firms are adjusting to new financial promotion rules, indicating a move towards stricter oversight in the crypto sector. Additionally, the EU is contemplating more stringent regulations for large AI models, which could have implications for AI-integrated blockchain technologies.

Tokenization and Brazilian Innovation

Elsewhere, Brazil is considering creating a regulatory sandbox to explore tokenization use cases. Such initiatives signal a growing interest in harnessing blockchain for broader financial applications and could serve as a model for other nations.

Market Insights and Investment Trends

Investment behaviors in cryptocurrency are influenced by a myriad of factors. Recent data reveals intriguing trends concerning the inflow and outflow of capital within the crypto market.

Investment Product Inflows

Cryptocurrency investment products have seen a substantial influx of funds recently. CoinShares reports that investment products have experienced their most significant inflow since July, indicating a renewed interest among investors despite recent price declines.

Monitoring Market Strategy

Investors continue to monitor economic indicators closely, such as inflation forecasts and geopolitical developments, as these elements significantly affect market strategies and investment decisions.

NFT and Digital Asset Initiatives

NFTs and other digital assets are gaining traction worldwide, with organizations and governments exploring innovative applications for this technology.

China’s NFT Platform Initiative

For example, the state-owned China Daily announced plans to launch an NFT platform, potentially linking it to popular marketplaces like OpenSea, illustrating both the growing influence of NFTs and the government’s interest in digital asset regulation.

NFT Vulnerabilities

However, the space is not without its challenges. Issues like the recent $1 million “rug pull” associated with the ‘Lucky Star Currency’ project highlight the potential risks in the NFT arena and the necessity for robust security measures.

Crypto Security Concerns

Security remains a significant concern in the cryptocurrency sector, with hacking attempts and security breaches continuing to pose threats to exchanges and digital asset holders.

Rising Cyber Threats

Upbit, a well-known crypto exchange, was reportedly targeted 159,000 times in the first half of 2021 alone, emphasizing the importance of advancing security protocols. This represents a massive 1,800% increase compared to the same period in 2020, indicating that as the crypto market grows, so do the attempts to exploit its vulnerabilities.

The Importance of Secure Platforms

Such incidents underscore the necessity for crypto firms to implement stringent security measures, improve user education on security best practices, and foster deeper cooperation with regulatory bodies to prevent these threats from undermining confidence in digital assets.

Future Projections and Considerations

As we look toward the future, several key issues continue to shape the trajectory of the crypto industry. Stakeholders must navigate these challenges to ensure sustainable growth and broader adoption.

Preparing for Regulatory Changes

With impending regulatory adjustments in various regions, cryptocurrency exchanges and projects need to remain adaptable. Proactive engagement with regulators and compliance with new laws will be essential to thriving in an increasingly regulated environment.

Technological Advancements

Investment in research and development to advance blockchain scalability, interoperability, and usability will remain critical. Such advancements will likely drive the adoption of cryptocurrencies in everyday transactions and more complex financial processes.

Advocating for Balance

Finding the right balance between regulatory measures and innovation remains crucial. Industry participants, from developers to policymakers, must work collaboratively to establish frameworks that protect consumers without stifling progress.

As we continue to navigate the crypto landscape’s complex terrain, staying informed and engaged will be vital for anyone invested in this transformative field. By understanding current challenges and opportunities, you can better anticipate the evolving dynamics of the crypto world.