? Which decentralized exchanges give you the best opportunities for earning from liquidity pools, while balancing yield, risk, and convenience?

What Are The Best Decentralized Exchanges For Liquidity Pools?

You’re trying to find the best places to provide liquidity, earn fees, and take advantage of token incentives. This article breaks down leading decentralized exchanges (DEXs), explains the models they use, and helps you decide which pools and networks match your goals and risk tolerance.

Why liquidity pools matter

Liquidity pools power automated market makers (AMMs), letting traders swap tokens without order books. You provide two (or sometimes one) tokens to a pool and earn a share of trading fees and sometimes additional yield farming rewards. Liquidity pools are central to DeFi—if you’re going to be a liquidity provider (LP), understanding where to allocate capital matters.

How to judge a DEX for liquidity pools

You’ll want to evaluate platforms by several criteria—TVL and volume, fees you’ll earn, impermanent loss risk, token incentives, chain and gas costs, security and audits, and UX. Each factor affects your expected returns and exposure.

Key evaluation criteria explained

- TVL and volume: Higher TVL and consistent trading volume generally mean more fee income and lower slippage.

- Fee structure: Fixed fee tiers and fee-on-transfer token handling change net yields.

- Impermanent loss (IL): Changes in relative token price can reduce your returns versus HODLing; pool design matters.

- Incentives: Liquidity mining can boost yields but can be temporary and risky.

- Chain/gas costs: High fees can eat small LP positions; Layer 2s and alternative chains can be cost-effective.

- Security: Audits, multisigs, timelocks, and a clean history reduce smart contract risk.

- UX and analytics: Good interfaces and analytics let you manage positions and monitor risks.

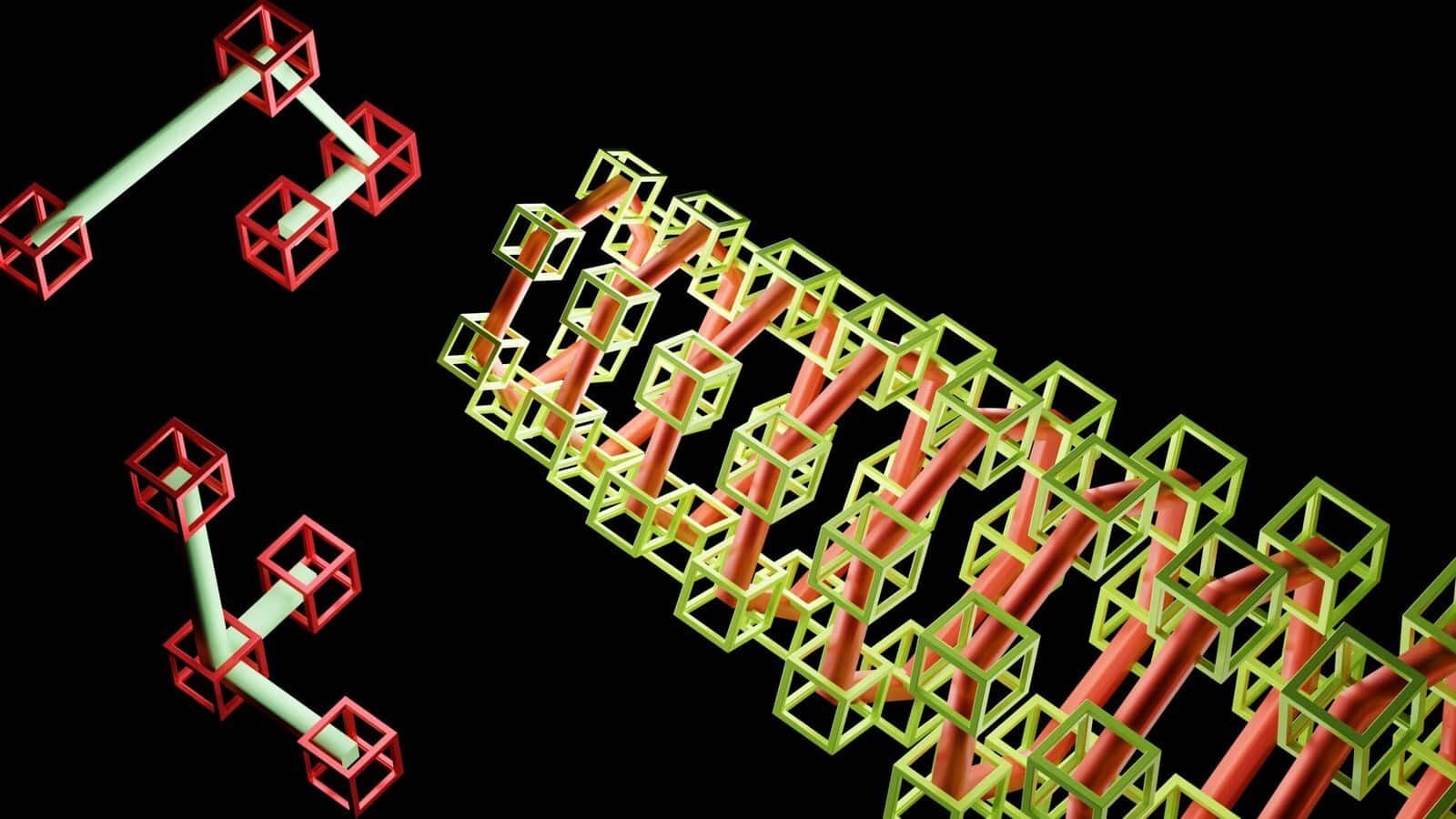

Overview of AMM models and why they matter

Different AMM designs produce different fee income, impermanent loss profiles, and management needs. Understanding them helps you pick the right DEX and pool.

Constant product AMM (x * y = k)

This is the classic model used by Uniswap V2 and many clones. It’s simple, permissionless, and works for most token pairs, but it can expose you to significant impermanent loss when token prices diverge.

Concentrated liquidity (Uniswap V3 model)

You can set price ranges where your liquidity is active, increasing capital efficiency and fee yield. You’ll need to manage positions actively; if price moves outside your range your position stops earning fees.

Stable-swap pools (Curve-style)

Optimized for pegged or similar-value assets (stablecoins or wrapped versions of the same asset). These pools give very low slippage and much lower IL, making them ideal for stablecoin liquidity provisioning.

Weighted pools and flexible AMMs (Balancer, Dodo)

They allow non-50/50 ratios and custom weights for pools, which can reduce IL for certain strategies or provide programmable exposure.

Order book + AMM hybrids

Some DEXs combine limit order mechanics with AMM functionality, offering different ways to provide liquidity and capture fees.

Top decentralized exchanges for liquidity pools (comparative table)

Below is a compact comparison to help you orient yourself. Metrics like TVL and volume change frequently—use this table as a snapshot of strengths and common use-cases.

| DEX | Chain(s) | AMM Type | Best for | Strengths | Considerations |

|---|---|---|---|---|---|

| Uniswap (V3) | Ethereum, L2s (Arbitrum, Optimism), others | Concentrated liquidity | Active managers seeking capital efficiency | High liquidity, strong security, many integrations | Requires active management; gas costs on mainnet |

| Curve Finance | Ethereum, L2s, Polygon | Stable-swap | Stablecoin/pegged asset pools | Extremely low slippage & IL for stable pairs; high TVL | Low fees for stable pools; limited for volatile pairs |

| SushiSwap | Multi-chain | Constant product + additional features | Cross-chain farming & incentives | Wide ecosystem, farms, BentoBox strategies | Historically incentive-driven; variable incentives |

| Balancer | Ethereum, Polygon, Arbitrum | Weighted pools, v2 vault model | Custom weights, composable pools | Flexible pool composition, efficient swaps | Complexity can be daunting |

| PancakeSwap | BNB Chain | Constant product | BSC users seeking low fees | Low gas, high TVL on BNB Chain, lots of farms | Centralization concerns for some users |

| Curve (convex + incent.) | Ethereum | Stable-swap + yield optimizers | Hands-off stablecoin LPs | Integrations with yield optimizers (Convex) | Rewards structures can be complex |

| Trader Joe | Avalanche | Constant product + staking | AVAX native liquidity | Fast finality, low gas on Avalanche | Smaller ecosystem than Ethereum |

| QuickSwap | Polygon | Constant product | Low-cost LP on Polygon | Cheap transactions, good liquidity for tokens on Polygon | Liquidity concentrated vs Ethereum |

| Raydium / Orca / Jupiter | Solana | AMM (varies) | Solana LPs & order flow | Very cheap, fast tx; integrated with orderbook DEXs | Less composability than EVM; ecosystem risks |

| Velodrome / Camelot / Synapse | Optimism / Arbitrum | AMM (gyro-style variants) | Optimism/Arbitrum liquidity | L2-native, lower gas, growing liquidity | Newer platforms can have variable incentives |

| Thorchain | Multi-chain (native) | Cross-chain AMM | Native asset cross-chain liquidity | Native Bitcoin and cross-chain capabilities | Different risk model; custody/design considerations |

Deep dives: what makes each leading DEX special

You’ll want to consider how each DEX earns fees, supports liquidity incentives, and manages risk. Below are profiles of the most commonly recommended DEXs for liquidity pools.

Uniswap (especially V3)

Uniswap V3 offers concentrated liquidity where you choose a price range. You can earn much higher fee yields per capital deployed if you pick ranges where trades happen. You’ll need to manage positions or use third-party managers/automations.

- Why you might use it: You want the most capital-efficient liquidity provision on Ethereum and major L2s.

- Risks: Active management required; mainnet gas costs can be high for small pools.

- Good for: High-volume pairs, concentrated strategies, market makers.

Curve Finance

Curve is optimized for stablecoins and pegged assets, delivering minimal slippage and minimal IL. If you provide liquidity to stable-stable pools (e.g., USDC/USDT/DAI), your exposure to price divergence is much smaller.

- Why you might use it: You want stable yields with minimal IL, often combined with Convex for boosted rewards.

- Risks: Smart contract risk and governance decisions; reward token impacts.

- Good for: Low-risk stablecoin LPing, getting yield on stable capital.

SushiSwap

SushiSwap operates across many chains and offers farming incentives and extra strategies (BentoBox, Kashi lending). It’s a generalist that frequently runs liquidity mining programs to boost yields.

- Why you might use it: You want cross-chain options and active incentive programs.

- Risks: Incentive-driven yields can decline; less capital efficiency than concentrated models.

- Good for: Yield seekers who want to chase incentives and multi-chain exposure.

Balancer

Balancer lets you create pools with arbitrary token weightings (e.g., 80/20), which changes IL dynamics and allows more flexible portfolio management. It’s useful if you want to maintain a particular exposure and still earn fees.

- Why you might use it: You want custom pool weights or multi-token pools.

- Risks: Complexity; certain pools can be low volume if not incentivized.

- Good for: Portfolio-based pools, index-like liquidity.

PancakeSwap

PancakeSwap is a dominant DEX on BNB Chain where gas is cheap, and yield farms are abundant. Many users looking for lower transaction costs operate here.

- Why you might use it: You want cheap transactions and many farm opportunities.

- Risks: Network centralization concerns and tokenomic risks.

- Good for: Smaller capital LPs and yield chasers on BNB Chain.

Solana DEXs (Raydium, Orca, Jupiter)

Solana DEXs offer extremely low transaction costs and fast settlement, which suits frequent rebalancing or active strategies. AMM designs vary and some integrate with central limit order book features.

- Why you might use it: Speed and low fees, good for active strategies on Solana.

- Risks: Different security model from EVM; occasional network outages historically.

- Good for: Users comfortable with Solana’s ecosystem and tooling.

L2 DEXs (Velodrome, Camelot, QuickSwap on Polygon)

Layer 2 DEXs let you avoid Ethereum mainnet gas while tapping into many of the same assets. They’re a great compromise between liquidity and transaction costs.

- Why you might use it: Lower gas, still access to competitive liquidity and incentives.

- Risks: Some L2s are newer and have smaller ecosystems.

- Good for: Smaller positions, frequent management, or trying new incentive programs.

Thorchain (cross-chain native assets)

Thorchain enables cross-chain swaps of native assets (e.g., native BTC) without wrapped tokens. It offers unique cross-chain liquidity but uses a different architecture and risk model.

- Why you might use it: You want native asset cross-chain swaps and liquidity.

- Risks: Different security assumptions, different token-based incentives.

- Good for: Native cross-chain liquidity needs.

Comparison: fee tiers, incentive styles, and typical yields

Different DEXs use different fee structures and reward models. Your realized yield is a function of trading volume, protocol fees, and additional reward tokens.

- Fee tiers: Some DEXs offer multiple fee tiers (e.g., 0.05%, 0.3%, 1%), letting you pick the best trade-off between fee income and attracting volume.

- Incentives: Liquidity mining can drastically raise APR for a time. Check whether rewards are vested or token-dilutive.

- Typical yields: Stable pools often yield lower fees but lower IL; volatile pairs yield higher fees but higher IL risk. Yields vary widely over time.

Table: typical pool choices and their trade-offs

| Pool type | Typical fee | Typical IL risk | Best use-case | Example DEXs |

|---|---|---|---|---|

| Stable-stable | 0.01–0.04% | Very low | Earning yield on stable assets | Curve, Convex, Curve pools on multiple chains |

| Stable-volatile (e.g., USDC/ETH) | 0.05–0.3% | Moderate | Balanced exposure to volatility | Uniswap V2/V3, SushiSwap |

| Volatile-volatility (e.g., ETH/ALT) | 0.3–1% | High | High fee potential for active managers | Uniswap, SushiSwap, PancakeSwap |

| Concentrated position | Protocol-defined | IL can be managed via ranges | High fee concentration if active | Uniswap V3 |

| Multi-token/index pools | Variable | Variable | Portfolio-like passive exposure | Balancer |

How to provide liquidity: step-by-step

You’ll typically follow similar steps across DEXs, though UI details change.

- Choose chain and DEX based on gas and liquidity.

- Select the pair and pool type (stable, concentrated, weighted).

- Approve tokens in your wallet (one-time per token per contract).

- Provide liquidity by supplying both tokens or a single-sided option where supported.

- Monitor position: fees accumulated, price movement, and any incentive programs.

- Withdraw when you want to exit or rebalance; remember to claim rewards if applicable.

Tips for approvals and gas optimization

- Approve only required allowances and consider using “infinite approvals” only if you trust the contract and prefer fewer approvals.

- Use networks and L2s for small positions to avoid excessive fees.

- Time transactions when gas is low if using Ethereum mainnet.

Impermanent loss (IL): what it is and how to calculate it

Impermanent loss happens because, after price changes, your pool share can be worth less than simply holding both tokens outside the pool. For constant-product AMMs, IL depends solely on price ratio change.

Formula and example

If the price changes by a factor k (new price / old price), impermanent loss percentage (IL) is:

IL = 1 – ( (2 * sqrt(k)) / (k + 1) )

Example: Price doubles (k = 2)

- sqrt(k) = 1.4142

- (2 * sqrt(k)) / (k + 1) = (2 * 1.4142) / 3 ≈ 0.9428

- IL ≈ 1 – 0.9428 = 0.0572 → 5.72%

So if one asset doubles versus the other, you’d have about 5.72% less value than if you’d simply held both tokens.

How concentrated liquidity affects IL

Concentrated liquidity doesn’t eliminate IL but can increase fee capture that offsets IL by focusing liquidity where trades occur. Still, you must actively manage ranges to maintain coverage.

Strategies to manage IL and maximize returns

You can use several strategies to reduce your IL exposure or to make IL less painful.

Use stable pools for low IL

If you want minimal IL, provide liquidity to stablecoin or tightly pegged token pools (Curve-style). Your yield will be lower but steadier.

Use concentrated liquidity with active management

If you’re comfortable monitoring positions, concentrated liquidity yields higher returns per capital. Tools and bots can help auto-rebalance ranges.

Employ single-sided staking where available

Some protocols let you stake a single token against a pool token or use vaults that auto-compound and manage rebalancing for you (e.g., Convex for Curve).

Hedge exposure

If you want to preserve exposure to a volatile asset while providing liquidity, you can hedge price moves with derivatives (futures) to offset IL. That adds complexity and cost but can be effective.

Chasing temporary incentives carefully

Liquidity mining can offer high APRs. If you chase them, check token reward vesting, token sell pressure, and the sustainability of incentives.

Security considerations you must check

Before you commit funds, verify:

- Audits by reputable firms.

- The protocol’s track record (no repeated exploits).

- Governance and multisig details: who controls upgrades and how changes are authorized.

- Timelocks and upgrade mechanisms.

- Whether the token reward model mints new tokens (which can dilute long-term APR).

Always assume smart contract risk exists. Diversify and avoid allocating your entire DeFi capital to a single protocol.

Tools and analytics to help you decide

You should use on-chain analytics and calculators to estimate yield, IL, and rewards:

- DeFiLlama: compare TVL across protocols and chains.

- Dune Analytics: community dashboards for volume and fees.

- Impermanent loss calculators: simulate price changes vs. HODLing.

- Token explorers and audit reports: check contract addresses and audit links.

- Wallet trackers: track positions and accrued fees across chains.

Example scenario: choosing between Curve and Uniswap V3 for USDC/ETH exposure

You want USDC/ETH exposure with yield. Ask yourself:

- Do you want low IL and stable returns? Use a stable asset pool like Curve only if you want stablecoin-only exposure, but Curve doesn’t host ETH/USDC in the same low-IL sense as stable-stable pools.

- Do you want higher fee yield and can actively manage positions? Uniswap V3 lets you concentrate liquidity around a chosen price range for ETH/USDC, increasing fee yields but requiring management.

- Do gas costs matter? Consider an L2 or sidechain deployment of these protocols if you’re small-cap.

Your decision should weigh expected volume, management capability, and gas costs.

Recommended DEXs by user profile

This quick guide helps you pick DEXs based on how you operate.

- You’re risk-averse and prefer stability: Curve (and Convex) stable pools.

- You’re an active trader or sophisticated LP: Uniswap V3 on L2s or mainnet; concentrate your liquidity.

- You’re chasing high APY and incentives: SushiSwap, PancakeSwap, QuickSwap—but be cautious with token emissions.

- You want cheap gas and frequent rebalancing: Polygon QuickSwap, Arbitrum/Optimism DEXs, Solana DEXs.

- You need cross-chain native liquidity: Thorchain (careful with different risk profile).

Checklist: How to evaluate a specific liquidity pool (table)

| Item | Why it matters | What to look for |

|---|---|---|

| TVL and historical volume | Fee income depends on volume | Stable or rising volume; high TVL usually means safe liquidity |

| Fee tier | Higher fees earn more per trade | Match fee tier to pair volatility |

| Reward tokens | Extra APR from liquidity mining | Check vesting and tokenomics |

| Audit history | Reduces smart contract risk | Multiple audits by reputable firms |

| Protocol age and track record | Maturity reduces unknown risks | Fewer critical incidents historically |

| Slippage and depth | Affects trader usage and fee flow | Deep pools attract more trades |

| Token pair characteristics | Stable vs volatile changes IL | Stable-stable |