Have you ever wondered what makes decentralized autonomous organizations, or DAOs, tick and which tokens are pivotal to their operation? DAOs represent one of the most intriguing innovations in the blockchain space, allowing communities to manage resources and make decisions in a decentralized manner. However, behind this idea lies an essential question: What are the best tokens for DAOs? Join us as we explore this topic to help you understand the role of tokens within these entities, and discover some of the most promising tokens facilitating the DAO ecosystem today.

Understanding DAOs

Before diving into the specifics of tokens, it’s crucial to grasp what DAOs are and why they are significant. Decentralized Autonomous Organizations are blockchain-based organizations controlled by smart contracts, providing a decentralized structure for decision-making and governance. They’re designed to eliminate centralized oversight, allowing stakeholders to vote on proposals and influence the project’s future.

The Importance of Tokens in DAOs

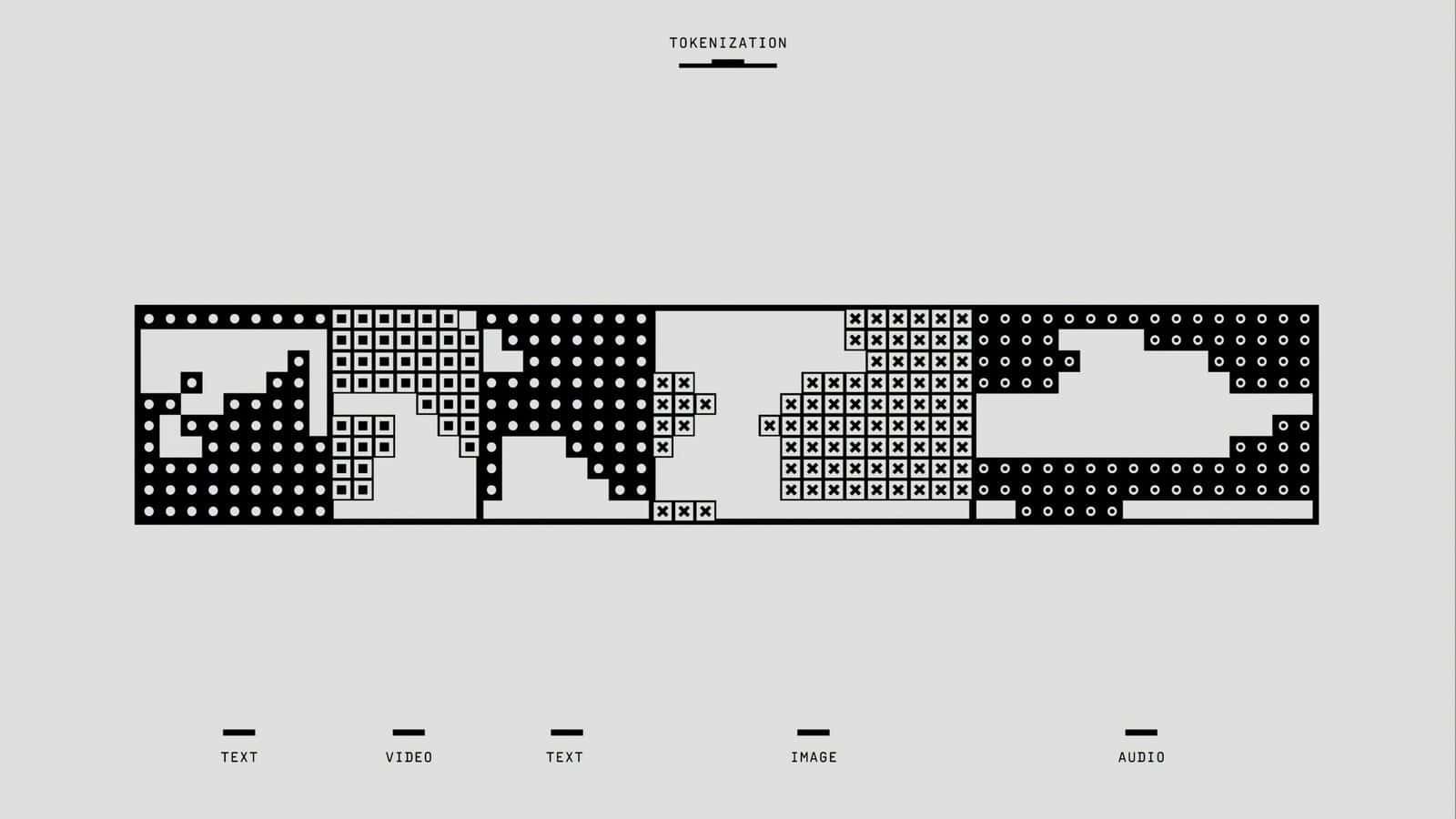

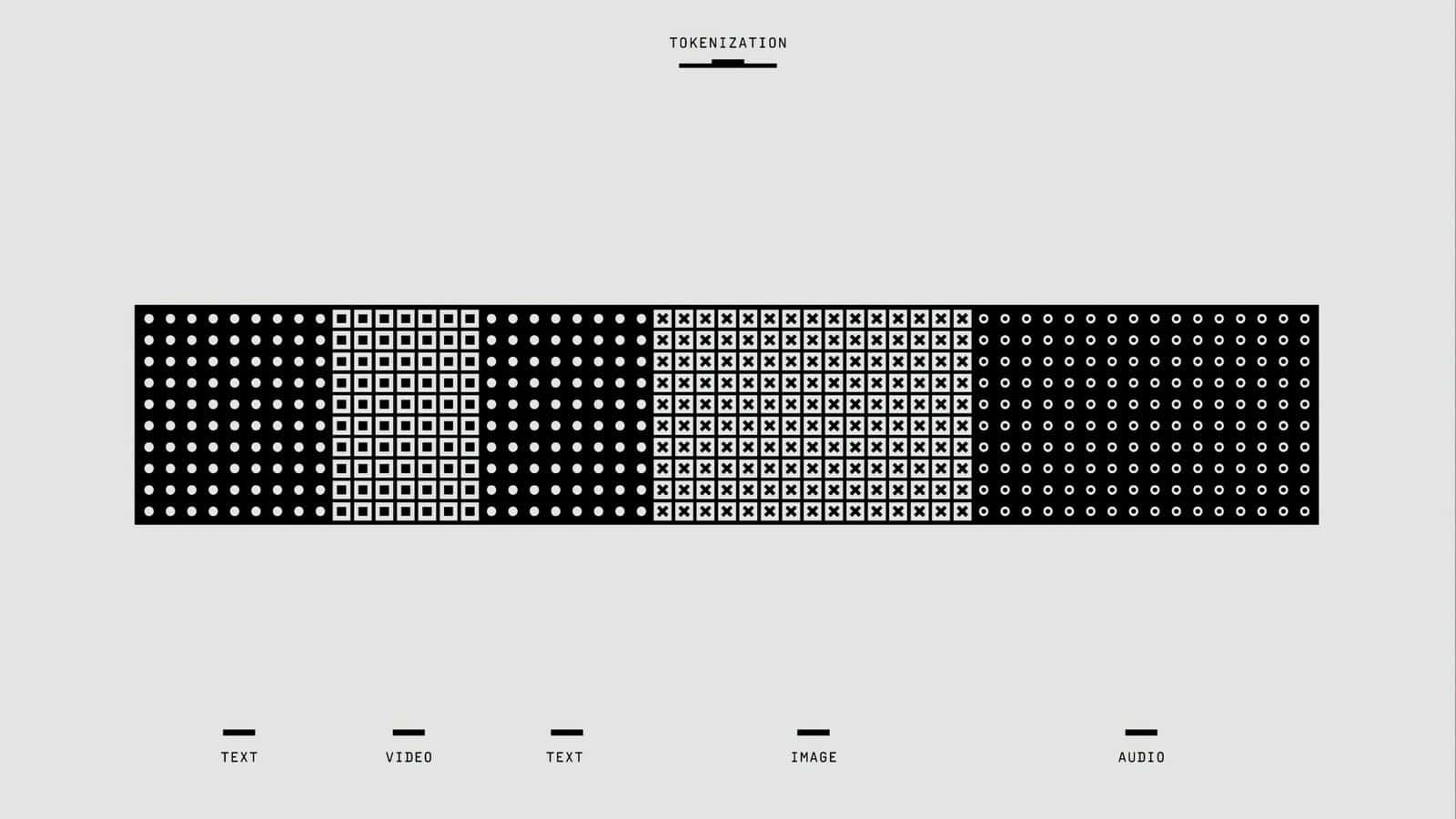

Tokens play a crucial role in the functioning of DAOs. They are typically utilized for governance, allowing token holders to vote on important matters related to the DAO. Beyond governance, tokens may also grant access to a DAO’s services or reflect ownership stakes in a project. Understanding which tokens best serve these purposes is essential for anyone participating in or creating a DAO.

Factors to Consider When Choosing DAO Tokens

Selecting the right tokens for a DAO involves several factors. Here’s a closer look at what you should keep in mind:

Governance Power

The influence a token grants in governing the DAO is one of the primary considerations. Some tokens provide more voting power per token held, while others might offer a more egalitarian approach by distributing voting power evenly among holders. Evaluating your DAO’s governance needs can greatly impact your token choice.

Token Utility

The utility of a token refers to how it can be used within the DAO. Whether for acquiring services, accessing exclusive content, or contributing to the organization of events, the utility will underpin a token’s value proposition. Choose tokens that align with your DAO’s mission and members’ needs.

Security and Reliability

Security is paramount in blockchain environments. You want to ensure that the tokens under consideration come from robust, secure blockchain networks. Furthermore, the reliability of the underlying technology can influence your confidence and functionality as a DAO member.

Community Support and Development

The community behind a token is a barometer of its potential success. Active and engaged communities are more likely to drive innovation and development, ensuring the token remains viable and relevant. Consider tokens with strong support networks and active developer engagement.

Liquidity

Liquidity often impacts the ease with which tokens can be bought, sold, or transferred. High liquidity tokens offer more flexibility for DAO members, making them attractive options for organizations anticipating regular interaction with their tokens.

Top Tokens for DAOs

Several tokens stand out today as integral to the DAO ecosystem. Let’s explore some of the most widely regarded tokens, highlighting their unique features and suitability for various DAOs.

Ethereum (ETH)

As the native currency of the Ethereum network, ETH is an inherently valuable token for many DAOs. Ethereum’s smart contract capability has been foundational in DAO creation, enabling autonomous governance and administration.

- Governance Capabilities: While not exclusively a governance token, ETH is essential in Ethereum-based DAOs for paying gas fees necessary for executing smart contracts.

- Utility: In addition to governance functionality, ETH is widely used for transactions, lending, and other DeFi activities.

- Community and Development: Supported by a vast global community and robust development infrastructure.

Maker (MKR)

The MakerDAO is one of the pioneering platforms in DAO governance, supporting the DAI stablecoin. MKR is crucial for its governance model.

- Governance Power: MKR allows holders to vote on adjustments to the DAI system, providing a direct say in critical operational decisions.

- Utility: Besides governance, MKR can be used as collateral within the Maker system.

- Security: Representative of a project with significant security measures, having survived notable challenges in its history.

Uniswap (UNI)

Uniswap is a major player in decentralized exchanges, and its governance token, UNI, facilitates decentralized decision-making within its protocol.

- Governance Capabilities: UNI holders can propose changes to the protocol, making it central to Uniswap’s decentralized governance.

- Community Engagement: UNI benefits from a large, devoted community and active developer support.

- Utility: Beyond governance, UNI can provide liquidity provision rewards, adding a financial incentive for holders.

Aave (AAVE)

Known for its contributions to decentralized lending, Aave’s token AAVE grants governance rights over its protocols.

- Governance and Control: AAVE holders decide on protocol parameters, proposals, and improvements, proving their importance in DAO operations.

- Risk Management: AAVE stakers can enhance network security and earn protocol fees through staking mechanisms.

- Developer Ecosystem: A thriving developer environment pushing continuous innovation.

Compound (COMP)

Compound is another strong player in the decentralized finance landscape, utilizing COMP for governance.

- Decentralized Decision-Making: COMP empowers holders to vote on and propose changes to protocol governance.

- Market Adoption: With significant adoption and integration into major DeFi platforms, COMP remains a widely recognized governance token.

- Innovation and Security: Constant innovation and established security measures bolster its reputation.

SushiSwap (SUSHI)

Born as a fork of Uniswap, SushiSwap’s SUSHI token has carved its niche in the DeFi space.

- Governance Influence: SUSHI offers governance power over the SushiSwap protocol, enabling changes through community consensus.

- Yield Farming Rewards: Apart from governance, SUSHI offers rewards for liquidity provision and farming activities.

- Community Strength: SushiSwap benefits from a passionate community that drives perpetual development and engagement.

Curve (CRV)

Curve Finance has become a key player in the DeFi sector, known specifically for its stablecoin swaps.

- Governance and Voting: CRV gives holders the ability to influence protocol developments and parameters.

- Incentive Structures: CRV is involved in rewarding liquidity providers, aligning with DAO usability and incentives.

- Unique Design Elements: Curve’s particular focus on stablecoin pools sets it apart in the DAO landscape.

Challenges in Selecting DAO Tokens

While many tokens offer enticing features, choosing the right combination of tokens for a DAO is not without its challenges. Here’s what you might face:

Balancing Decentralization and Efficiency

The balance between sufficient decentralization and effective governance can be challenging. Highly decentralized tokens might dilute voting power, making decision-making cumbersome, while lesser decentralization can risk centralization pressures.

Anticipating Future Jurisdictional Regulations

As DAOs are still relatively new, the regulatory gaze on how tokens are classified and utilized can pose issues. Ensuring legal compliance now and in the future is pivotal.

Navigating Market Volatility

Cryptocurrency markets are notoriously volatile, affecting token value and decision-making processes. Selecting tokens that can withstand price volatility helps stabilize your DAO’s operation.

Striving for Inclusivity

Ensuring that token distribution is fairly and broadly conducted can avoid concentration of power, which undermines the ethos of decentralization.

Future Trends in DAO Tokens

DAO tokens continue to evolve in response to the ever-changing blockchain landscape. Here are some trends worth watching:

Cross-chain Integration

As interoperability becomes more pronounced, expect DAO tokens to function across multiple blockchain platforms, increasing their utility and reach.

Changing Governance Models

Emerging ideas around experimental governance models may lead to the development of more sophisticated DAO tokens designed to support these innovations.

Focus on Sustainability

Environmental concerns associated with blockchain technology are sparking interest in sustainable tokens, which can become key players in DAO choices.

Enhanced Privacy Protocols

Elevated focus on privacy could lead to the integration of privacy-centric technologies within DAO tokens, ensuring privacy without compromising transparency.

Conclusion

As DAOs continually redefine organizational structures across industries, understanding and selecting the ideal tokens becomes increasingly critical. Ethereum, MakerDAO, Uniswap, Aave, Compound, SushiSwap, and Curve are merely the tip of the iceberg, each offering unique strengths and functionalities. Your choice should first and foremost align with your DAO’s vision, operational needs, and governance goals.

By staying informed on emerging trends and technologies, you will be better prepared to navigate this dynamic landscape successfully. Keep your eyes open for new opportunities, as the world of DAOs and their corresponding tokens offers immense potential for change and innovation.