Have you ever found yourself pondering over which tools might give you an edge in the world of crypto market analysis? Navigating the fast-paced and volatile landscape of cryptocurrencies can seem daunting, but armed with the right set of tools, you can make informed decisions and potentially seize lucrative opportunities. Let’s embark on this journey together to uncover some of the best resources available for analyzing the crypto market.

Understanding the Crypto Market

Before diving into the tools themselves, it’s important to grasp the fundamentals of the crypto market. The cryptocurrency market is a decentralized and digital space where a myriad of cryptocurrencies, including Bitcoin, Ethereum, and many altcoins, are traded. Due to its 24/7 nature and inherent volatility, staying informed and using reliable tools becomes paramount for successful trading and investing.

The Importance of Market Analysis

While it might be tempting to rely on instincts or trends espoused by online influencers, robust market analysis is a key factor in determining your success in the crypto arena. Proper analysis minimizes risks and maximizes opportunities by providing insights into market trends, price movements, and potential returns.

Types of Analysis in Crypto Market

Understanding the different types of analysis can further illuminate which tools might best serve your needs.

Technical Analysis

Technical Analysis (TA) involves studying price movements and historical data to predict future price movements. It relies heavily on charts and indicators, such as moving averages, volume, and relative strength index (RSI).

Fundamental Analysis

Fundamental Analysis (FA) focuses on the intrinsic value of a cryptocurrency by evaluating factors such as the project’s whitepaper, team, market demand, and technology. It helps to determine whether a cryptocurrency is undervalued or overvalued.

Sentiment Analysis

Sentiment Analysis involves gauging the market’s mood or emotions. It can be gleaned from social media, news articles, and forums to predict how market sentiment might impact cryptocurrency prices.

Essential Tools for Crypto Market Analysis

Now that you understand the basic types of analysis, let’s explore some essential tools that can help you excel in crypto market analysis.

Cryptocurrency Exchanges with Analytical Tools

Many cryptocurrency exchanges offer built-in tools and features for conducting basic analysis.

Binance

- Offers a variety of charts, indicators, and trading pairs for comprehensive analysis.

- Real-time order book and market depth provide insights into current market conditions.

Coinbase Pro

- Features detailed charting tools and historical data.

- Intuitive design makes it easy to spot trends and make informed trades.

These platforms not only facilitate trading but also offer useful data for analysis.

Charting Platforms

Charting platforms provide comprehensive tools for technical analysis.

TradingView

- One of the most popular charting platforms used by crypto traders.

- Offers a wide range of indicators, drawing tools, and customizable charts.

- Community-driven, allowing you to view configurations from other traders.

CryptoCompare

- Offers crypto-specific charts and tools.

- Provides real-time data and multiple indicators.

- Rich data sets for deep dives into market trends.

These platforms are invaluable for technical traders who rely heavily on chart patterns and indicators.

Portfolio Trackers

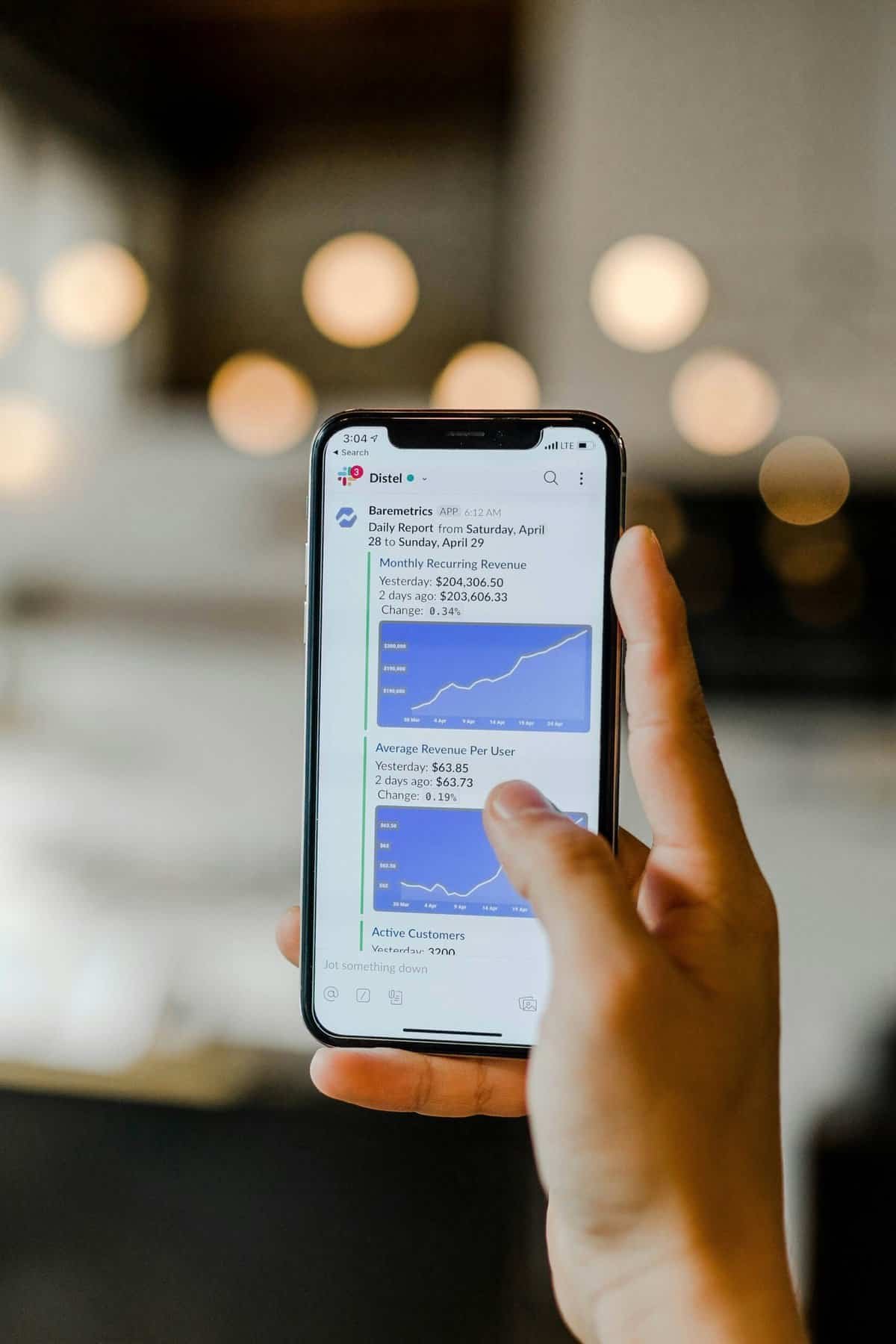

Tracking your portfolio effectively can give you a better idea of your investments’ performance.

CoinStats

- Allows you to track over 8,000 tokens and currencies.

- Synchronizes with exchanges and wallets for real-time updates.

- Provides news and market data relevant to holdings.

Delta

- Offers detailed analytics and real-time tracking of your crypto assets.

- Provides portfolio charts and performance insights.

- Syncs transactions from exchanges automatically.

Portfolio trackers help you manage your investments efficiently by providing clear insights into your holdings and their performance over time.

News Aggregators

Staying updated with the latest news is crucial as the crypto market is heavily influenced by news events.

CoinDesk

- Offers comprehensive news and insights on the cryptocurrency industry.

- Covers a variety of topics, from blockchain developments to market fluctuations.

CryptoPanic

- A news aggregator platform providing real-time updates from various sources.

- Offers a sentiment analysis feature to gauge market mood via news headlines.

News aggregators are essential for fundamental and sentiment analysis, keeping you informed of all the market-moving events.

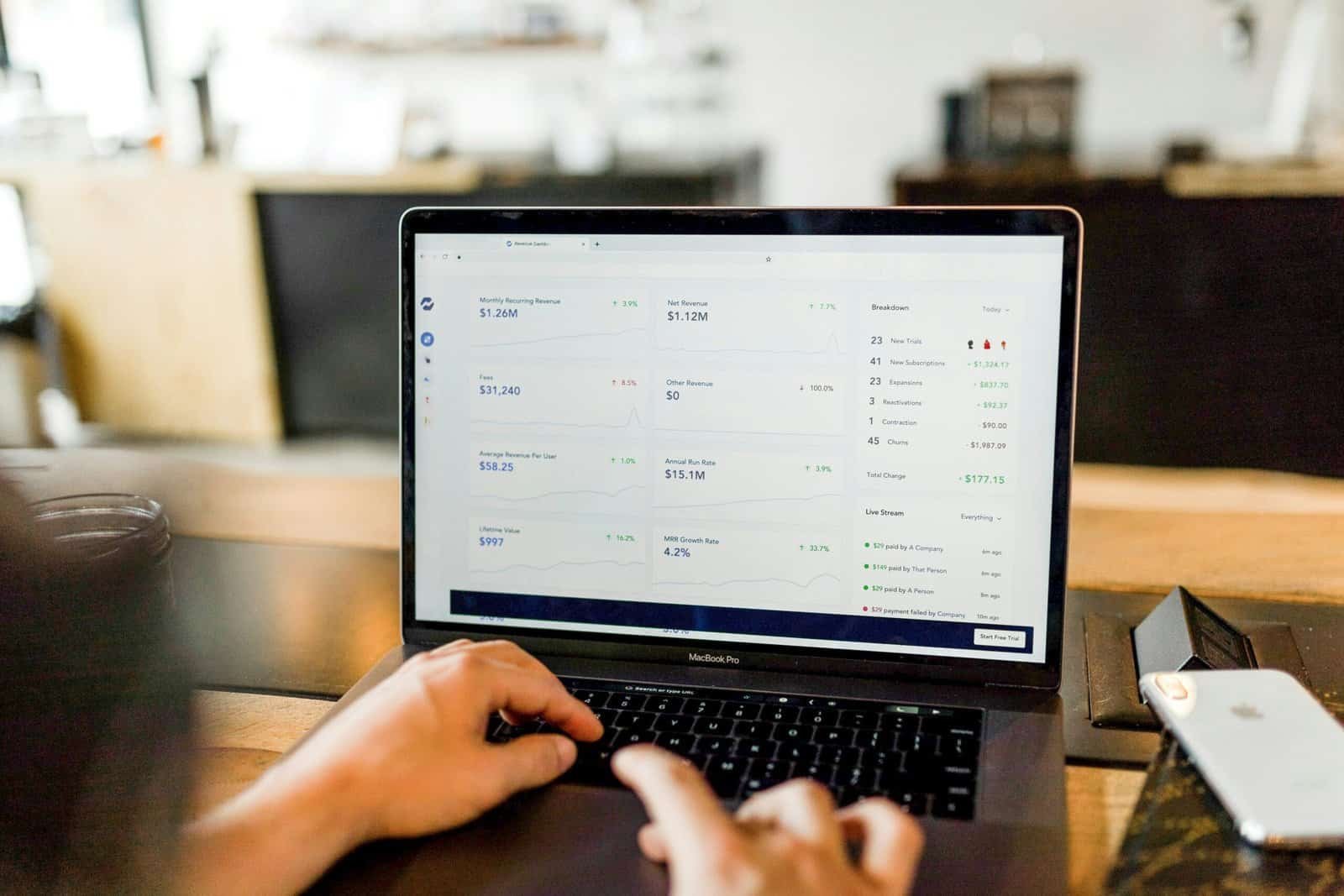

Data Aggregation Platforms

Data aggregation platforms compile data from multiple sources to offer an overview of the market.

CoinMarketCap

- Provides information on cryptocurrency prices, charts, and market cap.

- Offers historical data, rankings, and detailed coin information.

CryptoCompare

- As a cryptocurrency data aggregator, it offers price updates, historical data, and exchange rates.

- Provides APIs for developers to access crypto data for custom use cases.

These platforms help you understand the big picture by providing comprehensive data across the crypto space.

Blockchain Explorers

Blockchain explorers help you verify transactions and gain insights into blockchain data.

Etherscan (Ethereum Blockchain)

- Allows you to view transactions, wallet balances, and smart contracts.

- Provides analytics such as gas prices and token information.

Blockchain.info (Bitcoin Blockchain)

- Offers details on block confirmations, transactions, and mining information.

- Useful for verifying Bitcoin transactions.

Blockchain explorers are essential for those who wish to delve into the specifics of blockchain activity, useful for fundamental analysis.

Putting It All Together

Combining these tools and types of analysis can give you a well-rounded approach to crypto market analysis. You might prefer technical charts for short-term trading, fundamental analysis for long-term investments, and sentiment analysis to stay in sync with market mood.

The Role of Community and Social Media

An often-overlooked aspect of crypto market analysis is the role of community and social media. Platforms like Twitter, Reddit, and Telegram can provide real-time insights into market sentiment and potential market movements due to their frequent updates and discussion threads.

- Follow key influencers, analysts, and projects for timely updates.

- Use hashtags like #crypto and #bitcoin to find trending topics.

- Subreddits like r/cryptocurrency offer a wealth of discussion threads and insights.

- Useful for understanding community sentiment and emerging trends.

These platforms encourage interaction and provide a feed of diverse perspectives and real-time updates, crucial for sentiment analysis.

Challenges in Crypto Market Analysis

While these tools offer immense value, there are challenges that one should be aware of.

Understanding Technical Jargon

The crypto world is filled with technical terms and abbreviations that can be overwhelming. Taking time to learn and understand this jargon is crucial to utilizing tools effectively.

Market Volatility

The crypto market’s notorious volatility can result in rapid changes that make analysis challenging. It’s essential to remain agile and update strategies based on new information.

Security Concerns

Security is paramount in the crypto world, given the prevalence of scams and hacking attempts. Always prioritize using reputable tools and keeping your assets secure.

Final Thoughts

By now, you should have a better sense of the landscape of crypto market analysis tools available to you. Each tool serves a unique purpose, and combining their uses will grant you a comprehensive overview suitable for robust decision-making. From charting platforms to news aggregators, effectively utilizing these tools will enhance your trading strategies and investment decisions, bringing you closer to mastering the crypto market. Remember, the more you familiarize yourself with these resources, the better equipped you’ll be in your crypto endeavors. Good luck!