Are you trying to figure out which exchanges are best for futures and derivatives trading and which decentralized venues move the most volume?

What Exchanges Are Best For Futures And Derivatives Trading?

You’ll find a broad range of venues for futures and derivatives, from highly regulated legacy exchanges that handle commodity and financial futures to crypto-native centralized and decentralized platforms that offer perpetuals, options, and exotic derivatives. Each has its own trade-offs in liquidity, counterparty risk, fees, product breadth, and regulation.

Why this matters to you

Choosing the right exchange affects execution quality, margin requirements, settlement certainty, and your regulatory exposure. Whether you’re hedging a real-world position, arbitraging across venues, or speculating with leverage, your choice should match your priorities: speed, cost, custody control, or regulatory safety.

Two broad categories: centralized vs decentralized derivatives venues

You should distinguish between centralized (CEX) and decentralized (DEX) derivatives platforms. Both have strengths and weaknesses that matter depending on your goals.

Centralized exchanges (CEX)

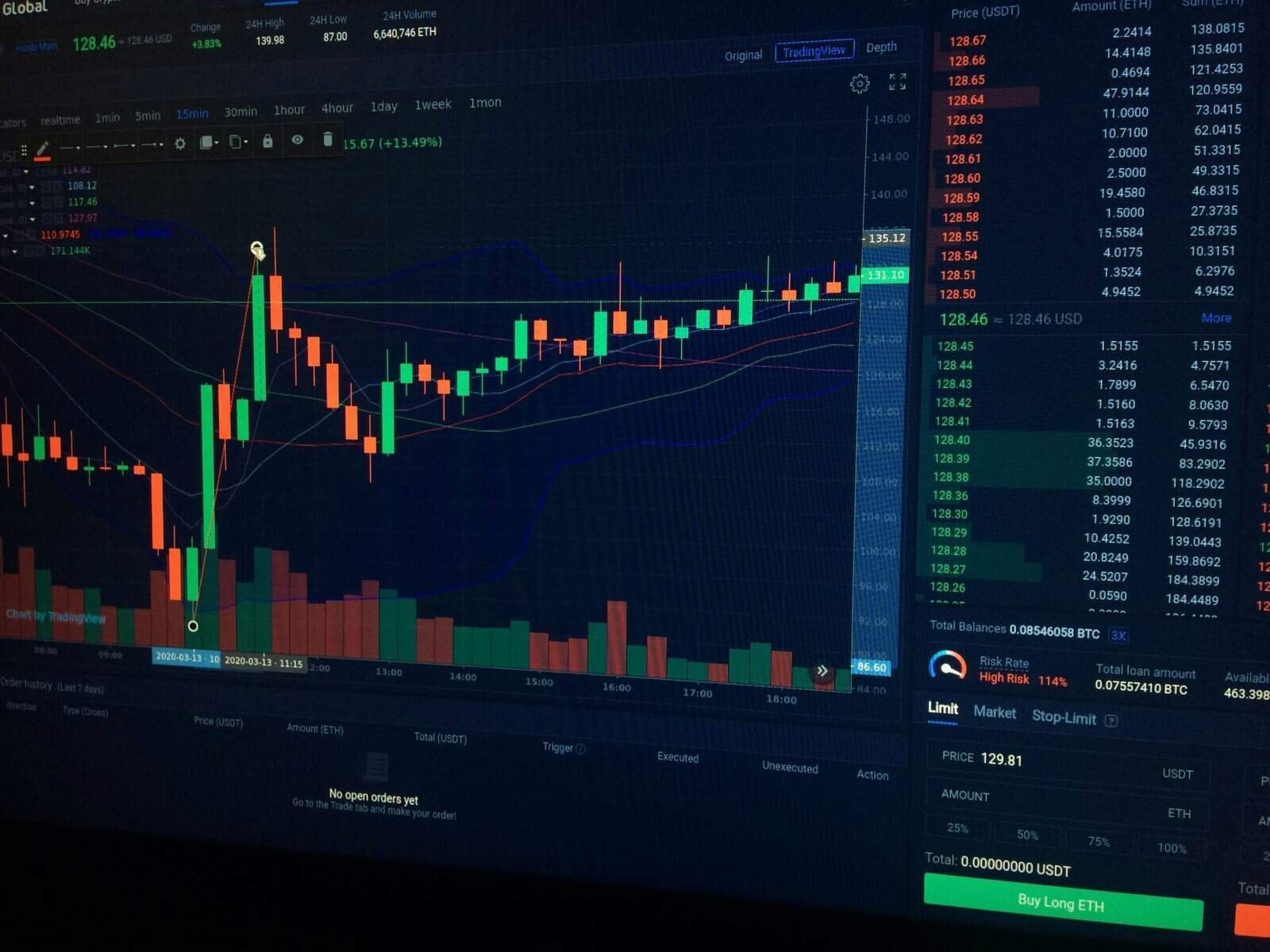

Centralized exchanges act as intermediaries, holding user funds, matching orders on order books, and often offering advanced features like deep liquidity, low-latency matching, and customer support. They tend to offer a full suite of order types, high leverage, and established risk controls.

- Advantages you get: deep liquidity, professional-grade matching, higher leverage, advanced order types, often tighter spreads.

- Trade-offs for you: custodial counterparty risk, KYC/AML requirements, regulatory constraints based on your jurisdiction.

Decentralized exchanges (DEX) for derivatives

Decentralized derivatives platforms use smart contracts to enable permissionless trading, often non-custodial so you retain control of collateral. They can offer better privacy, composability with other DeFi protocols, and censorship resistance.

- Advantages you get: custody over your collateral, composability, permissionless access, transparent on-chain settlement.

- Trade-offs for you: usually lower liquidity than top CEXs, potential smart contract risk, more limited order types and execution speed.

Key criteria you should consider when choosing an exchange

You’ll want to look at several factors before committing capital to a venue. These factors determine whether an exchange suits your trading style and risk tolerance.

Liquidity and depth

You should check order-book depth and how large orders impact price. High liquidity reduces slippage on entry and exit, and is critical for large position sizes.

Fees and funding rates

You’ll want to evaluate trading fees, maker/taker structures, withdrawal costs, and funding rates for perpetual contracts. Fees can materially affect profitability, especially for high-frequency strategies.

Leverage and margin mechanics

Different exchanges expose you to different maximum leverage and margin models (cross vs isolated margin, initial and maintenance margin). You should understand how margin calls and liquidations work.

Order types and execution

If you need advanced order types (stops, trailing stops, iceberg orders), use a venue that supports them. Fast execution and low latency are essential for arbitrage and market-making.

Counterparty and custody risk

Centralized platforms require you to trust them with funds. If you want self-custody, decentralized alternatives are preferable—recognize the smart contract risk involved.

Regulation and legal safety

If you need regulatory protections or want to trade on behalf of clients, choose regulated exchanges. If you prioritize permissionless access, DEXes are preferable but come with fewer legal protections.

Security and insurance funds

You should verify each exchange’s security history, audits, cold storage practices, and whether they maintain insurance funds to cover defaults.

Geographic availability and KYC

Some exchanges restrict products or services by region. You should check whether the exchange will let you trade futures given your residency.

Top centralized futures and derivatives exchanges

Below you’ll find major regulated and crypto-focused centralized venues that dominate futures and derivatives volumes. Each has distinct use cases.

Legacy regulated derivatives exchanges

These venues are the go-to for institutional and commodity futures, with strong regulatory oversight.

- CME Group (Chicago Mercantile Exchange): You’ll find futures contracts on interest rates, equity indices (S&P 500 E-mini), commodities, and crypto (Bitcoin, Ether futures). CME is attractive for institutional-grade clearing and margining.

- ICE (Intercontinental Exchange): You’ll get energy and financial futures, options, and swaps with strong clearing infrastructure.

- Eurex: You’ll use it for European equity index and interest rate futures with deep liquidity.

- CBOE: Known for options and volatility products (VIX futures).

- SGX (Singapore Exchange): Useful for Asian hours exposure and commodities.

You should use legacy exchanges when you need regulated clearing, consistent settlement finality, and institutional-grade amenities.

Crypto-focused centralized exchanges (CEX)

These platforms concentrate on crypto derivatives—perpetual swaps, futures, options, and leveraged tokens.

- Binance: You’ll find deep liquidity and a wide product range (USDT- and coin-margined futures, options). Binance has been the highest-volume crypto derivatives venue historically, but watch regulatory restrictions in some jurisdictions.

- Bybit: You’ll like the UX, competitive fees, and strong liquidity in many BTC/ETH perpetual markets.

- OKX: Offers a broad derivatives suite, including futures, perpetuals, and options across many tokens.

- Bitget, KuCoin, Gate.io: You’ll use them for access to a wide range of altcoin derivatives, often with competitive incentives.

- FTX (formerly): You should not use it—FTX collapsed in 2022. It is included in history only as a cautionary example.

Use CEXs when you want deep liquidity or product breadth, but always weigh custodial risk and regional legal access.

Comparison table: major centralized derivatives exchanges

| Exchange type | Notable venues | Strengths for you | Typical risks |

|---|---|---|---|

| Legacy regulated | CME, ICE, Eurex, CBOE, SGX | Institutional clearing, regulatory oversight, settlement certainty | Slower product innovation for crypto; access requires institutional accounts |

| Crypto CEX | Binance, Bybit, OKX, Bitget, KuCoin | High liquidity for crypto futures, many pairs, low latency | Custodial risk, regulatory constraints, regional restrictions |

Top decentralized derivatives exchanges (DEXes) and perpetual platforms

You might prefer DEXes if self-custody and on-chain settlement are important. Decentralized derivatives have matured quickly and now support perpetuals, options, and synthetic assets.

Major decentralized perpetual and margin platforms

These platforms provide on-chain perpetual contracts, often with AMM or virtual AMM (vAMM) models.

- dYdX: You’ll find an order-book-based perpetuals DEX (L2 on Cosmos/SEI or previous versions on Ethereum) optimized for low fees and low-latency trading. dYdX has historically been a top decentralized derivatives venue by volume.

- GMX: You’ll use it for spot and perpetual swap trading via an AMM-like liquidity pool and for multi-chain access on Arbitrum and Avalanche. GMX emphasizes low slippage for large trades.

- Perpetual Protocol (Perp V2): You’ll trade on a vAMM that allows leveraged perpetual positions with on-chain collateral.

- Kwenta (Synthetix): You’ll gain synthetic asset exposure and derivatives denominated in synths backed by the Synthetix collateral pool.

- Gains Network: You’ll see leveraged trading with an on-chain replicated model (note higher risk and differing mechanics).

- Ribbon/Opyn/Hegic (options on-chain): You’ll access on-chain options, though liquidity can be limited compared with centralized options markets.

Top decentralized exchanges by volume (general list)

Below is a general list of high-volume decentralized exchanges and derivatives platforms you’ll commonly see ranked by volume. Volumes change quickly, so use live analytics platforms (CoinGecko, CoinMarketCap, Dune, DeFiLlama) for up-to-date numbers.

| Category | Platform (typical high-volume names) | What you should know |

|---|---|---|

| Spot DEX (AMM) | Uniswap (v3), PancakeSwap, Curve Finance, SushiSwap | These handle the majority of decentralized spot volume, especially stablecoin and large-cap token trading. |

| Perpetual / derivatives DEX | dYdX, GMX, Perpetual Protocol, Kwenta | These capture most decentralized derivatives volume—dYdX and GMX are often top derivatives DEXs. |

| Options / synthetics | Synthetix/Kwenta, Lyra, Opyn, Ribbon | On-chain options and synths are growing but have less volume than perpetuals. |

Why volumes on DEXes matter to you

Volume influences price discovery and slippage; higher-volume DEXes usually offer better execution for large orders. You should also check total value locked (TVL) for liquidity capacity and examine how the platform handles funding and insurance (if any).

Liquidity structure: order book vs AMM vs vAMM

Your execution depends heavily on how the exchange structures liquidity.

Centralized order books

You’ll benefit from a traditional order book where limit orders, market orders, and matching engines create tight spreads. Order books can support advanced strategies like pegged orders and algorithmic execution.

AMM-based DEXes

You’ll encounter AMMs for spot trading and some derivatives. AMMs price trades via liquidity pools and formulaic curves (Uniswap’s x*y=k, Curve’s stable curves). AMMs can be efficient for retail-sized trades but may have higher slippage for large trades and imperfect capital efficiency for derivatives.

Virtual AMM (vAMM) for perpetuals

You’ll see vAMMs used by Perpetual Protocol, which decouples collateral pools from the pricing function to replicate perpetual swap behavior. vAMMs offer continuous pricing but can expose traders to larger funding volatility.

Fees, funding, and funding rate mechanics

Fees and funding rates influence your carry costs and long-term profitability.

Trading fees

You’ll usually pay maker and taker fees on centralized exchanges; some DEXs charge swap fees or protocol fees distributed to LPs. Fee tiers can vary with VIP programs.

Funding rates on perpetuals

You’ll pay or receive funding payments that keep perpetual prices tethered to the underlying spot. High funding costs can make carrying leveraged positions costly; you should check historical funding volatility.

Funding and fee table example

| Cost type | CEX | DEX/perpetuals |

|---|---|---|

| Trading fee | Maker/taker tiers; often 0.02%–0.1% | Swap fee or protocol fee; varies 0.03%–0.3% for spot; perpetuals may have small taker fees |

| Funding rate | Periodic funding, often every 8 hours | Continuous or periodic funding on-chain; rates can be volatile |

| Withdrawal/gas cost | Exchange withdrawal fee | Gas fees on-chain; layer-2 reduces costs |

Leverage, margin, and liquidation mechanics

You’ll need to understand how leverage is offered and what liquidation mechanisms are used.

Leverage levels

CEXs can offer high leverage (up to 100x on certain BTC perpetuals historically), while DEXs often limit leverage to lower multiples due to on-chain margin constraints. Higher leverage increases liquidation risk.

Margin models

You’ll see isolated margin (separate for each position) and cross margin (positions share margin). Cross margin reduces liquidation risk if you have diversified positions, but it can expose a larger portion of your holdings to a single market move.

Liquidation processes

You should know how liquidations happen: centralized exchanges use internal matching or liquidation engines; decentralized platforms may trigger on-chain liquidations executed by bots or rely on automated mechanisms that can be front-run, causing slippage and partial fills.

Settlement, custody, and counterparty risk

You should choose the custody model that fits your trust preferences.

Centralized custody

You’ll hand assets to the exchange. This can be convenient and fast for margin transfers, but it exposes you to exchange insolvency and operational risk. Check the exchange’s track record, proof-of-reserves (if available), and insurance policies.

Non-custodial (on-chain) custody

You’ll keep custody of your assets when trading on DEXs, reducing counterparty risk, but you assume smart contract and wallet security risk. Use hardware wallets and audited platforms when possible.

Settlement finality

You’ll get immediate on-chain settlement clarity with DEXs. With legacy exchanges, you’ll rely on clearinghouses—this is stable and familiar for institutions, but it’s centralized.

Security, audits, and insurance funds

You should research how exchanges secure funds and handle defaults.

Smart contract audits and bug bounties

If you use DEXs, check for independent audits, bug bounty programs, and the protocol’s response history to disclosures. No audit guarantees safety; consider time in market and the team behind the protocol.

Insurance funds and socialized losses

CEXs typically maintain insurance funds to absorb liquidation shortfalls; DEXs may have insurance or socialized loss mechanisms. Understanding who bears the loss is critical in stressed markets.

Regulatory and compliance considerations

You should assess legal exposures.

Jurisdictional restrictions

You may be restricted from using certain derivatives products based on your country of residence. Regulated exchanges enforce KYC/AML and may restrict leveraged products.

Tax and reporting

Derivatives can create complex tax events (realized/unrealized P&L, margin transfers, funding). You should keep meticulous records and consult a tax professional.

Institutional vs retail-friendly compliance

If you trade professionally, you’ll prefer exchanges with institutional custody and post-trade reporting. If you value privacy, decentralized platforms may appeal more but offer fewer formal protections.

How to choose the best exchange for your needs

You should prioritize based on your strategy, size, and risk tolerance.

If you’re an institutional or large-volume trader

You’ll want regulated venues (CME, ICE) or the top crypto CEXs with deep liquidity and institutional-grade connectivity (FIX APIs, co-location, custody options). Focus on execution quality, clearing, and compliance.

If you’re a retail leveraged trader

You’ll balance between CEXs (for liquidity and order types) and DEXs (for custody). If you’re short-term oriented, low fees and tight spreads matter more.

If you want self-custody and permissionless access

You’ll pick decentralized perpetual platforms (dYdX, Perpetual Protocol, GMX). Be diligent about smart contract security and slippage.

If you’re hedging real-world exposures

You’ll use regulated futures for settlement certainty and recognized contract specifications (e.g., CME Bitcoin futures, commodity futures).

Practical recommendations and combos

You should use a combination tailored to your use case.

- For deepest crypto derivative liquidity: use top CEXs (Binance, Bybit, OKX) for major pairs and large order sizes.

- For non-custodial perpetuals and DeFi exposure: use dYdX or GMX for on-chain access and composability.

- For institutional clearing and large-scale hedging: use CME or ICE for standard contracts with regulated clearinghouses.

- For options strategies: consider legacy options exchanges for size and reliability; use Lyra or Ribbon for smaller on-chain option strategies.

How to start trading futures and derivatives step-by-step

You’ll want a plan before placing leveraged trades.

1. Define your objective

Decide whether you’re hedging, speculating, arbitraging, or providing liquidity.

2. Choose the right venue

Match the venue’s strengths to your objective (liquidity, custody, jurisdictional compliance).

3. Learn the product specifications

Read contract sizes, tick values, funding intervals, margin calls, and maintenance margins.

4. Start small and test

Open small positions to test order execution, fees, and liquidation behavior.

5. Implement risk controls

Use stop losses, position limits, and keep sufficient margin to avoid cascading liquidations.

6. Monitor funding and fees

Track funding rates and cumulative fees; factor them into your P&L.

7. Keep records and report taxes

Log trades, margin transfers, and realized P&L for tax and compliance.

Glossary (quick reference for terms you’ll see)

You’ll encounter these commonly used terms while trading futures and derivatives.

- Perpetual swap: A derivative that mimics futures but without expiry, maintained by funding payments.

- Funding rate: Periodic payments from longs to shorts (or vice versa) to tether perpetuals to spot.

- Initial margin: Required collateral to open a leveraged position.

- Maintenance margin: Minimum collateral to keep a position open before liquidation.

- Liquidation: Forced closure of a position when margin falls below maintenance.

- vAMM: Virtual Automated Market Maker used in some perpetual DEXs to price positions.

- TVL (Total Value Locked): Amount of assets locked in a DeFi protocol, a proxy for liquidity.

Frequently asked questions (FAQ)

You should get clear answers to the most common questions traders ask.

Which exchanges have the lowest slippage for large futures trades?

For large crypto futures trades, the top centralized exchanges (Binance, Bybit, OKX) typically offer the deepest liquidity and lowest slippage. For on-chain large trades, GMX on Arbitrum or Avalanche and dYdX (L2) can provide reasonable execution but may still lag CEXs.

Are decentralized derivatives safer than centralized ones?

Decentralized venues reduce counterparty and custodial risk because you keep funds in your wallet, but they introduce smart contract risk and potentially lower liquidity. Safety depends on what type of risk you prioritize.

How do funding rates affect my strategy?

If funding rates are persistently positive, longs pay shorts; carrying a long position becomes expensive. You should factor funding into carry costs and avoid extended leverage when funding is high.

Can you transfer open positions between exchanges?

Typically no. Positions are tied to the exchange or smart contract where you opened them. If you want exposure elsewhere, you need to close positions and re-open on the target venue or use synthetic hedges.

How should you protect large positions from sudden volatility?

Use layered orders (stop-loss plus limit), cross-margin only if you have diversified collateral, and ensure you maintain excess margin above maintenance levels. For very large exposures, you may use OTC or block trades on regulated venues.

Final checklist to evaluate an exchange before trading

You should run through this checklist to validate any exchange:

- Is the exchange legally accessible from your jurisdiction?

- Does it have sufficient liquidity for your target contract size?

- What are the maker/taker fees and expected funding rates?

- What leverage and margin model are used?

- How are liquidations handled and what happens in extreme stress?

- Does the exchange have a good security track record and insurance provisions?

- If decentralized, are contracts audited and battle-tested?

- Can you integrate the exchange with your trading tools (API, execution algos)?

- What are the tax and reporting implications?

Closing guidance

You’ll find that no single exchange is “best” for every trader and every strategy. For major institutional or high-volume activity, regulated exchanges and top crypto CEXs typically give you the execution and reliability you need. If you prioritize custody and permissionless access, decentralized derivatives platforms are increasingly viable—but you must accept smart contract risk and liquidity limitations.

Keep updating your knowledge of volumes and platform health by following live analytics and community commentary, and always test your assumptions with small trades before scaling. Your success in futures and derivatives trading depends as much on venue selection as on discipline, risk management, and execution quality.