Have you ever wondered what crypto mining is all about and whether it’s still a profitable venture? You’re not alone! Many people are curious about this digital gold rush and its potential for financial gain. Let’s explore the ins and outs of crypto mining and see how it fits into the evolving world of cryptocurrencies and the metaverse.

Understanding Crypto Mining

To get started, let’s break down what crypto mining really means. In essence, crypto mining is the process of validating transactions and adding them to a blockchain. Cryptocurrency miners use powerful computers to solve complex mathematical problems, and in return, they receive newly minted coins as a reward. Sounds intriguing, right? But there’s much more to it than meets the eye.

The Nuts and Bolts of Blockchain

The blockchain is the technology that powers cryptocurrencies like Bitcoin and Ethereum. It is a digital ledger that keeps a secure and decentralized record of transactions. You could think of it like a huge Excel sheet that’s maintained not by a single entity but by a network of computers all over the world. These computers, or nodes, make sure every transaction is legitimate.

How Crypto Mining Maintains Blockchain Integrity

Within this system, miners play a vital role. They validate transactions by solving cryptographic puzzles, which ensures that the blockchain remains secure and trustworthy. Once a problem is solved, the transaction block is added to the chain, and the miner is rewarded with cryptocurrency. This is known as the Proof of Work (PoW) mechanism, which is the most common mining protocol.

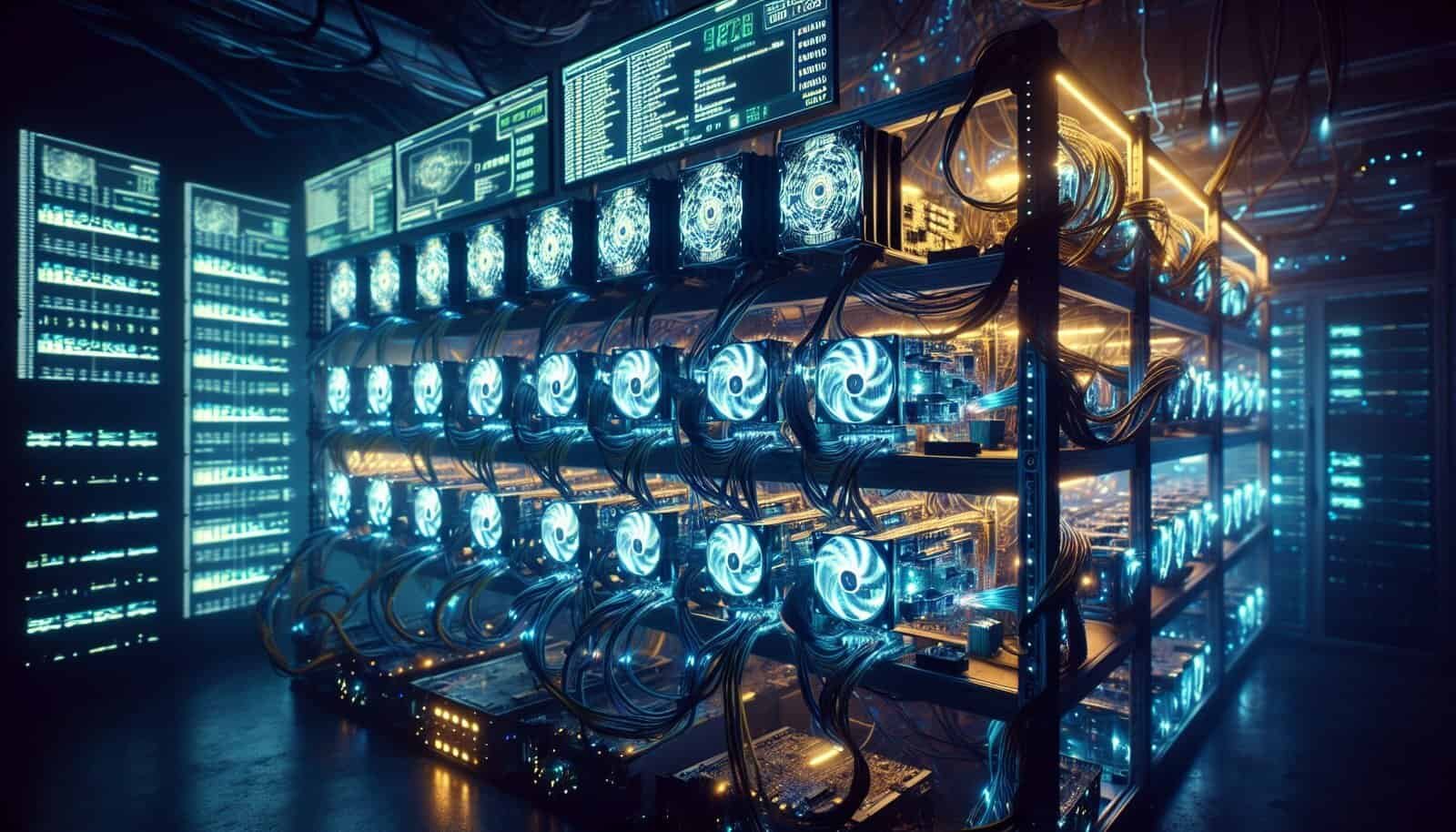

Equipment Needed for Crypto Mining

If you’re thinking about starting your mining journey, you’ll need some hardware. Initially, miners could get by with CPUs (Central Processing Units) but now, due to increased difficulty levels, more powerful GPUs (Graphics Processing Units) or even ASICs (Application-Specific Integrated Circuits) are required. Investing in the right equipment is crucial, as it directly impacts your mining efficiency and profitability.

| Equipment Type | Description |

|---|---|

| CPU | Initially used for mining but now largely obsolete due to low power. |

| GPU | More efficient than CPUs and still widely used for various cryptocurrencies. |

| ASIC | Highly specialized and efficient hardware optimized for specific cryptocurrency algorithms. |

Is Crypto Mining Still Profitable?

This is the burning question that everyone wants answered! The profitability of crypto mining depends on several factors, making it a dynamic and sometimes unpredictable venture. Let’s look at some of these core components that can impact your bottom line.

Difficulty Level

One key factor is the mining difficulty level. As more miners join the network, the competition increases, and it becomes harder to solve the mathematical puzzles. This means you’ll need more computational power, which can drive up costs.

Energy Costs

Mining is energy-intensive. Whether you’re mining from the comfort of your home or on an industrial scale, electricity consumption is a big part of the equation. It’s essential to calculate how your local energy rates affect your profit margin. In some regions, cheaper electricity can make mining lucrative.

Cryptocurrency Market Value

The price of the cryptocurrency you’re mining has a direct impact on profitability. If the market value drops significantly, it may no longer be cost-effective to continue mining. Keeping a keen eye on market trends is vital for decision-making.

Block Rewards and Halving Events

Over time, many cryptocurrencies undergo halving events, which reduce the reward given for mining a block by half. This event decreases the rate of new coins entering circulation and has historically influenced price. Understanding how these events affect your potential earnings is crucial.

Navigating the Metaverse with Crypto

Now that you have a grasp on crypto mining, you might wonder how it all connects with the metaverse. The metaverse is an emerging digital universe that blends augmented reality (AR), virtual reality (VR), and traditional web elements. Crypto is poised to play a pivotal role in these virtual spaces.

Cryptocurrency as Currency in the Metaverse

Cryptocurrencies are often used as a medium of exchange within the metaverse. Whether you’re purchasing virtual real estate, digital goods, or services, crypto provides efficient and decentralized financial transactions that are perfect for a digital landscape.

NFTs and Digital Ownership

Non-fungible tokens (NFTs) are digital assets that represent ownership of unique virtual items and have gained tremendous popularity. From art and music to virtual real estate, NFTs redefine the concept of owning collectibles in the digital world. They are bought and sold using cryptocurrencies, underscoring the synergy between crypto and the metaverse.

Smart Contracts and Decentralized Platforms

Decentralized applications (dApps) and smart contracts are built on blockchain technology, bringing transparency and security to transactions within the metaverse. You can think of smart contracts as automated digital agreements that execute when predetermined conditions are met, eliminating the need for intermediaries.

Challenges of Crypto Mining in Today’s World

Like any other technology, crypto mining isn’t without its challenges. Let’s explore some obstacles miners face and how they can potentially overcome them.

Environmental Concerns

The energy-intensive nature of mining has raised significant environmental issues. The carbon footprint associated with mining operations is a growing concern, and sustainable practices are being sought. Some miners are turning towards renewable energy sources to mitigate the environmental impact.

Regulatory Issues

Regulatory landscapes around crypto mining vary by region and can be unpredictable. Staying informed about legal developments in your area is crucial. Complying with regulations can be complex but ultimately necessary to operate legally and ethically.

Volatility and Risks

The volatility of cryptocurrency prices is another challenge. Rapid price swings can affect profitability and may lead to financial loss. Diversification and strategic planning can reduce risks associated with market volatility.

Future of Crypto Mining

Despite the challenges, the future of crypto mining holds promising developments. Innovations and advancements are continuously shaping this digital frontier, offering opportunities for those willing to adapt.

Transition to Proof of Stake (PoS)

Some cryptocurrencies are moving away from energy-intensive PoW mining to more sustainable models like Proof of Stake (PoS). This system reduces energy consumption as it requires validators to hold and lock up coins rather than complete complex computations.

Mining Pool Collaborations

Mining pools allow miners to combine their resources and share rewards, increasing the chances of earning for participants. This collaborative approach makes mining accessible to a wider audience and can stabilize earnings.

Innovations in Energy Efficiency

As the industry matures, new technologies are being developed to enhance energy efficiency. Companies are exploring ways to lower energy consumption through innovative designs and alternative power solutions.

Conclusion

Crypto mining is a fascinating and evolving field, full of potential but not without its complexities. By understanding the core elements that influence mining profitability and staying informed about the metaverse’s developments, you can make thoughtful decisions about entering or continuing in this space.

As you ponder the world of crypto mining, consider the potential rewards and the inherent challenges. Whether mining is still profitable depends on various factors unique to your situation, from the type of cryptocurrency to your local energy costs. Keeping these insights in mind will help you navigate the digital landscape more effectively. Happy mining!