Have you ever wondered why so many investors are turning their attention to tokens with real-world utility? In the vast landscape of cryptocurrency and blockchain technology, the allure of tokens has captivated not just enthusiasts and tech-savvy individuals but also seasoned investors who are on the lookout for new opportunities. But what exactly makes these tokens with real-world applications so appealing, and how can investing in them benefit you?

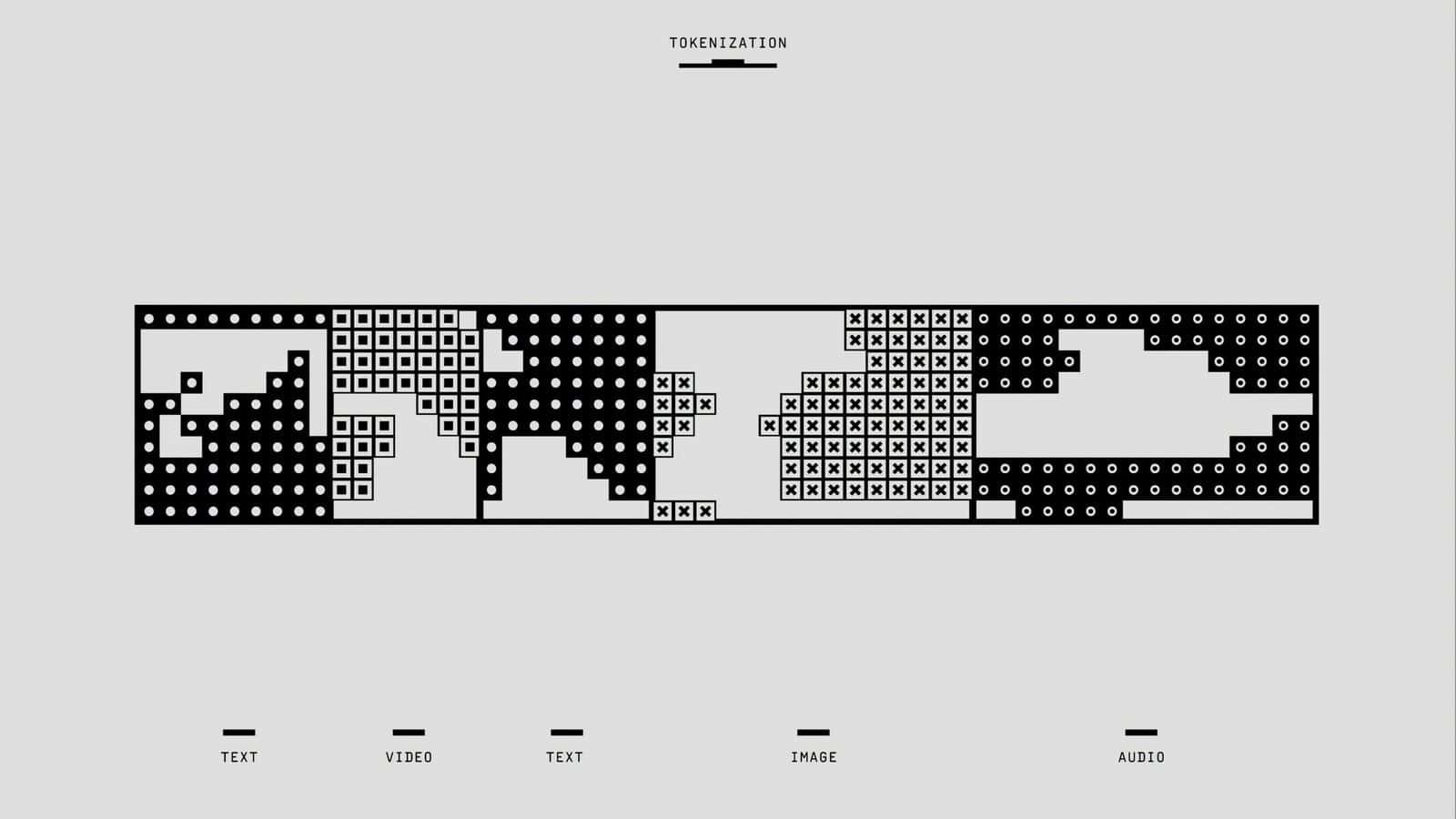

Understanding Tokens with Real-world Utility

Before we delve into the benefits, it’s crucial to understand what tokens with real-world utility are. Simply put, these tokens are digital assets that offer practical use cases beyond just being a speculative investment. Unlike traditional cryptocurrencies like Bitcoin, which primarily serve as a store of value or a medium of exchange, these tokens are designed to have functional roles in specific applications. They could provide access to services, enable decentralized applications (DApps), or facilitate transactions within particular ecosystems.

Types of Real-world Utility Tokens

Tokens can come in many forms, each tailored for different applications and industries. Let’s explore some common types:

- Utility Tokens: These are used to access a product or service within a blockchain ecosystem. A popular example would be Ethereum’s Ether, which powers transactions and interactions on its platform.

- Security Tokens: These represent ownership in an asset, similar to traditional securities. They can provide dividends, revenue sharing, or even a say in company decisions.

- Payment Tokens: These are primarily used as a medium of exchange, intended to buy goods and services.

- Governance Tokens: Designed to give holders the power to influence decisions within a blockchain ecosystem, often seen in decentralized finance (DeFi) projects.

- Asset-backed Tokens: These are tied to real-world assets, such as real estate, precious metals, or even carbon credits, offering a digital representation of tangible goods.

Importance of Real-world Utility

The real value of these tokens lies in their utility. Unlike pure speculative investments, tokens with practical applications offer more than just price appreciation. They solve problems, enhance efficiency, and open new possibilities across various industries. This real-world utility helps to stabilize their value over time, as the demand for the token is driven by its usability rather than merely market speculation.

The Benefits of Investing in Tokens with Real-world Utility

Now that you have a basic understanding of these tokens, let’s explore the advantages they bring to your investment portfolio.

Diversification and Risk Management

One of the primary principles of investing is diversification—spreading your investments across different assets to reduce risk. Tokens with real-world utility provide an excellent opportunity for diversification. By investing in a broad range of tokens across different sectors and applications, you can potentially shield your portfolio from volatility inherent in the crypto market.

Long-term Value Proposition

Tokens that have real-world use cases are often more resilient to market fluctuations. Their value proposition isn’t solely based on speculative trading but on actual application and demand. As blockchain technology gains wider adoption in industries such as finance, healthcare, supply chain, and entertainment, tokens that enable these applications are likely to maintain or grow their value over time.

Access to Innovative Projects

Investing in real-world utility tokens often means you’re supporting innovative and groundbreaking projects. These projects leverage blockchain technology to create decentralized solutions, streamline operations, and offer new business models. By investing in these tokens, you become part of the journey toward technological advancement and potentially reap substantial rewards as these projects succeed.

Potential for Passive Income

Some tokens, particularly those focused on decentralized finance (DeFi), offer holders the prospect of earning passive income. Through mechanisms such as staking, yield farming, or participating in liquidity pools, you can earn returns on your investments. This can be particularly appealing if you’re looking to generate income without having to actively trade or sell your assets.

Greater Transparency and Security

Blockchain technology, the underlying platform for these tokens, is renowned for being secure and transparent. All transactions are recorded on a public ledger, making it difficult for any fraudulent activity to occur. This transparency ensures that investors can verify and trust the origins and use of the tokens they hold, reducing the risk associated with investment fraud.

Real-world Applications and Examples

To further grasp the potential of tokens with real-world utility, let’s explore some examples and sectors where these tokens are making a tangible impact.

Financial Services

The financial sector has been significantly influenced by blockchain and crypto tokens. For instance, stablecoins are utilized for cross-border transactions, eliminating the need for intermediaries and offering faster, more cost-effective transfers.

Supply Chain Management

Tokens are revolutionizing supply chain management by providing real-time tracking and verification of goods. This enhances transparency, reduces fraud, and improves efficiency from production to delivery.

Healthcare

In healthcare, tokens enable secure sharing of medical records, safeguarding patient privacy while ensuring accurate and efficient information flow among healthcare providers.

Renewable Energy

Tokens in the energy sector facilitate peer-to-peer energy trading, allowing individuals to buy and sell surplus renewable energy, promoting sustainability and reducing reliance on traditional power grids.

Real Estate

Real estate tokenization enables fractional ownership, making property investments more accessible. This democratizes the market and provides liquidity in a traditionally illiquid asset class.

Gaming and Entertainment

Gaming tokens allow players to make in-game purchases, trade items, and earn rewards, thereby enhancing the gaming experience. Entertainment tokens can grant access to exclusive content or events.

Potential Challenges and Considerations

While investing in tokens with real-world utility presents numerous advantages, there are also challenges and considerations to keep in mind.

Regulatory Environment

As the token landscape is still evolving, regulatory scrutiny is expected. It’s essential to stay informed about the legal status of the tokens you’re planning to invest in, as regulations can impact their value and your ability to trade them freely.

Technological Risks

The rapid pace of technological advancement means that some projects may face unforeseen challenges. Investing in tokens with real-world utility often involves betting on the success of new technologies, which may not always achieve their intended goals.

Market Volatility

Despite their utility, tokens can still be subject to market volatility. Factors such as market sentiment, macroeconomic trends, and technological disruptions can impact their prices.

Research and Due Diligence

Given the diversity of tokens available, conducting thorough research is crucial. You’ll need to evaluate the project’s whitepaper, team, technological innovation, and roadmap to ensure that it aligns with your investment goals and risk tolerance.

How to Start Investing in Tokens with Real-world Utility

If you’re interested in exploring this investment avenue further, here are some steps to get you started:

Educate Yourself

Take the time to learn about blockchain technology, how tokens work, and the various use cases available. This foundational knowledge will aid in making informed investment decisions.

Choose a Reliable Exchange

Select a reputable cryptocurrency exchange that offers a wide range of tokens with real-world utility. Ensure the platform provides robust security features to safeguard your investments.

Diversify Your Investments

To mitigate risks, diversify your portfolio by investing in multiple tokens across different sectors and applications. This way, you can benefit from various opportunities and reduce potential losses.

Stay Updated

The crypto space is dynamic and ever-changing. Keep abreast of the latest developments, project updates, and market trends. Engage with communities, follow influential figures in the industry, and subscribe to reliable news sources.

Assess Risk Tolerance

Understand your risk tolerance before investing. Real-world utility tokens, while promising, can still be volatile, and your investment should align with your overall financial strategy and risk appetite.

Conclusion

Investing in tokens with real-world utility holds a world of potential opportunities and benefits for you. These tokens not only diversify your portfolio but also provide exposure to promising projects and industries poised for disruption by blockchain technology. While challenges and risks exist, the prospect of long-term value, passive income, and participation in innovative solutions make them an exciting addition to any investment strategy.

By remaining informed, conducting thorough research, and strategically diversifying your investments, you can confidently navigate the evolving landscape of tokens and harness their tangible impact. Whether you’re new to the world of crypto or an experienced investor, embracing tokens with real-world utility could be a rewarding journey towards financial growth and societal transformation.