Have you ever wondered what makes cryptocurrency such a buzzword these days? Even if you don’t entirely understand its mechanics, perhaps you’ve heard a friend or colleague talk about investing in Bitcoin or Ethereum. Cryptocurrency isn’t just a fleeting trend; it’s rapidly becoming a significant part of the financial landscape. But what exactly are the advantages of using digital currencies like Bitcoin, Ethereum, and others? Let’s explore the benefits of integrating cryptocurrencies into your financial world, highlighting how they can offer unique advantages over traditional money systems.

Understanding Cryptocurrency

Before diving into the benefits, it’s essential to grasp the basics of what cryptocurrency is. Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies are typically decentralized and leverage blockchain technology—a distributed ledger enforced by a network of computers (often referred to as nodes).

Features of Cryptocurrency

Cryptocurrencies possess unique characteristics that set them apart from fiat currency. Here’s a brief overview:

Decentralization: Most cryptocurrencies are based on blockchain technology, which is decentralized. This means no single entity has complete control over the entire network, reducing the chances of manipulation.

Security and Anonymity: Cryptocurrencies use cryptographic techniques to secure transactions, ensuring a high level of security and, in some cases, anonymity.

Limited Supply: Many cryptocurrencies, like Bitcoin, have a capped supply which can potentially protect against inflation.

By understanding these features, you can better appreciate the advantages they bring to the table.

Benefits of Using Cryptocurrency

Now that you’re familiar with the basics, let’s discuss the numerous benefits of using cryptocurrency.

Enhanced Security

One of the foremost advantages of cryptocurrencies is their inherent security. Traditional banking systems can be vulnerable to hacks, fraud, and identity theft. Cryptocurrencies, on the other hand, use advanced encryption techniques and blockchain technology to ensure that transactions are secure. This reduces the risk of fraud significantly.

Protection Against Inflation

Inflation is a common concern with fiat currencies, where central banks print more money, reducing its value. Cryptocurrencies like Bitcoin are designed to have a limited supply. For example, there will only ever be 21 million Bitcoins in existence. This scarcity can help protect against inflation, potentially preserving your purchasing power in the long run.

Lower Transaction Costs

International money transfers can be costly due to hefty fees charged by banks and money transfer services. Cryptocurrencies significantly reduce these costs. By bypassing intermediaries, the transaction fees associated with cryptocurrency transfers are typically much lower, saving you money.

Faster Transactions

Cryptocurrency transactions can be processed much quicker than traditional banking transactions, especially for international payments. While a wire transfer may take several days, a Bitcoin transaction can be completed within minutes, making it highly efficient.

Improved Accessibility

Cryptocurrency is accessible to anyone with an internet connection, empowering people who lack access to traditional banking systems. In many parts of the world, a surprising number of people remain unbanked, lacking access to vital financial services. Cryptocurrency opens up the potential for banking to these populations, enabling them to participate in the global economy.

Financial Freedom and Autonomy

Cryptocurrencies provide you with unparalleled financial freedom. You have full control over your assets without relying on banks or financial institutions. This autonomy allows you to access and transfer your funds anytime, without any restrictions imposed by third parties.

Potential for High Returns

The cryptocurrency market is known for its volatility, which can be a double-edged sword. While the high fluctuations carry a risk of loss, they also offer opportunities for significant gains. Many early investors in Bitcoin have multiplied their initial investments exponentially. If managed wisely, cryptocurrencies can yield high returns on investment.

Transparency and Immutability

Blockchain, the technology behind cryptocurrencies, is transparent and immutable. This means that once a transaction is recorded on the blockchain, it cannot be altered. This feature provides an additional layer of security and trust, preventing fraudulent activities and enhancing transparency in financial dealings.

Diversification of Investment Portfolio

Cryptocurrencies offer a new asset class that can diversify your investment portfolio. Traditional portfolios typically rely on stocks, bonds, and other traditional assets. Adding cryptocurrencies to your portfolio can spread risk and potentially increase returns, making it an attractive option for many investors.

Privacy and Anonymity

Although not entirely anonymous, cryptocurrencies can offer a higher degree of privacy than traditional banking systems. You don’t need to provide identity verification for every transaction, which keeps your personal information more protected.

Understanding the Risks

While the benefits are compelling, it’s crucial to understand the risks associated with using cryptocurrencies.

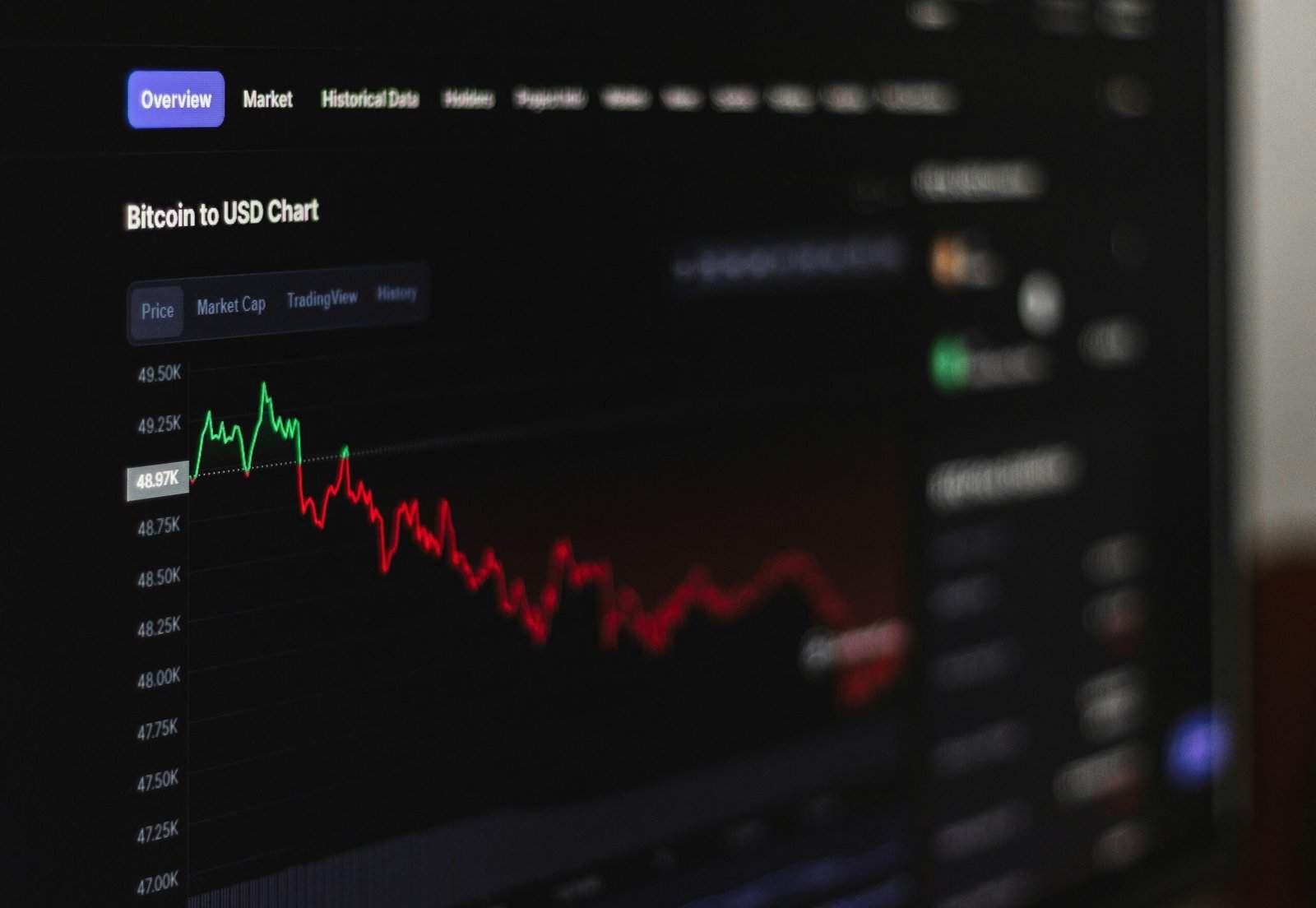

Market Volatility

The cryptocurrency market is highly volatile. Prices can skyrocket to significant highs but also drop drastically with little warning. This volatility means it’s essential to invest wisely and not invest more than you can afford to lose.

Lack of Regulation

The cryptocurrency market lacks comprehensive regulation, which can pose challenges. Without regulatory oversight, there’s a higher risk of fraud and market manipulation. Therefore, you should conduct thorough research and exercise caution.

Security Risks

Although the blockchain is secure, individual wallets can be vulnerable to hacking and theft if not protected adequately. It’s essential to use secure, reputable platforms and take necessary precautions to safeguard your crypto assets.

Limited Acceptance

While cryptocurrency adoption is growing, it’s far from universal. Certain merchants and services do not accept crypto, limiting where it can be used directly. Although this is changing over time, it remains a consideration when relying solely on digital currencies.

Practical Steps to Start Using Cryptocurrency

If you’re interested in exploring the benefits of cryptocurrency, here are some practical steps to consider.

Educate Yourself

Education is key to understanding the complexities and opportunities within the crypto space. Numerous online resources, courses, and communities can provide the knowledge needed to make informed decisions.

Choose a Secure Wallet

Decide on a secure wallet to store your cryptocurrencies. Wallets can be hardware-based or software-based, each offering different levels of security and convenience. Ensure you choose one that suits your needs and provides robust security features.

Select a Reputable Exchange

To buy or trade cryptocurrencies, you’ll need to use an exchange. Research and choose a reputable platform that is known for its security, user-friendly interface, and positive customer feedback. Ensure it supports the cryptocurrencies you intend to purchase.

Start Small

It’s wise to start with a small investment until you’re comfortable with how the markets work. This approach allows you to learn and understand the dynamics without exposing yourself to significant financial risk.

Stay Updated

The crypto world is rapidly evolving, with new developments emerging regularly. Stay informed about the latest trends, regulatory changes, and innovative projects to make educated decisions about your investments.

Secure Your Assets

Use strong passwords, enable two-factor authentication, and back up your wallet to increase security. Being proactive about security can protect your assets from potential threats.

The Future of Cryptocurrency

Cryptocurrencies are more than just a digital version of money; they represent a shift towards a more inclusive, transparent, and secure financial system. As technology advances, the potential applications for blockchain and digital currencies expand, influencing various sectors from finance to supply chain management. While the road ahead is filled with challenges, the benefits of cryptocurrency suggest a promising future.

Growth in Adoption

The adoption of cryptocurrencies is expected to grow as more individuals and institutions recognize their advantages. From facilitating cross-border transactions to tokenizing assets, cryptocurrencies offer diverse applications that foster their acceptance and integration into daily life.

Regulatory Developments

As adoption increases, regulators worldwide are paying closer attention to cryptocurrencies. While regulation can impose certain restrictions, it can also provide legitimacy and protection to consumers, encouraging broader use and acceptance.

Technological Innovations

Ongoing technological improvements in blockchain technology will likely address existing challenges, such as scalability and energy consumption. These innovations will enhance the efficiency and sustainability of cryptocurrency networks.

Conclusion

Cryptocurrency offers a myriad of benefits, from enhanced security and financial freedom to potential investment gains and greater transaction efficiency. However, like any investment or financial tool, it’s crucial to weigh these benefits against potential risks and make informed decisions. Embracing cryptocurrency is not just about following a trend but understanding how it can fit into and improve your financial life. By staying informed and cautious, you can leverage the advantages of this innovative technology while safeguarding your assets. Whether as an investment vehicle or a new way to transact, cryptocurrency is undoubtedly reshaping the future of finance.